Friday, April 8, 2016

CU Borrowings from Federal Reserve Discount Window, Q1 2014

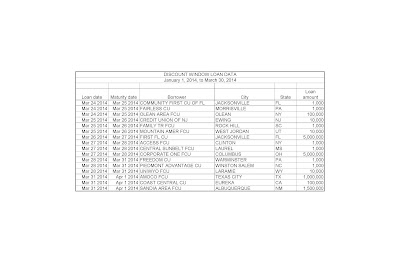

The Federal Reserve reported that 116 credit unions borrowed from its Discount Window during the first quarter of 2014.

In comparison, 100 credit unions borrowed from the Federal Reserve during the fourth quarter of 2013.

The Federal Reserve is required to disclose with a two year delay information on borrowings from the Discount Window.

The aggregate number of transactions were 121. The aggregate amount borrowed was $79.124 million.

The average amount borrowed from the Discount Window by a credit union was $653,917. The median Discount Window borrowing was $10,000. This indicates that numerous borrowings by credit unions were to test their ability to access the Federal Reserve's Discount Window.

Almost all credit unions that borrowed from the Federal Reserve's Discount Window did so through the primary credit program, which is reserved for healthy institutions.

In comparison, 100 credit unions borrowed from the Federal Reserve during the fourth quarter of 2013.

The Federal Reserve is required to disclose with a two year delay information on borrowings from the Discount Window.

The aggregate number of transactions were 121. The aggregate amount borrowed was $79.124 million.

The average amount borrowed from the Discount Window by a credit union was $653,917. The median Discount Window borrowing was $10,000. This indicates that numerous borrowings by credit unions were to test their ability to access the Federal Reserve's Discount Window.

Almost all credit unions that borrowed from the Federal Reserve's Discount Window did so through the primary credit program, which is reserved for healthy institutions.

Subscribe to:

Post Comments (Atom)

the total amount of borrowing is peanuts when compared to the bailout from the Fed the banks enjoyed. This is a non issue.

ReplyDelete