Monday, June 6, 2016

Are NCUSIF Reserves Underestimated?

At the end of the first quarter of 2016, the National Credit Union Administration (NCUA) reported that the National Credit Union Share Insurance Fund (NCUSIF) had reserves of $152.2 million as of March 31, 2016 -- $9.9 million is for specific natural person credit unions and $142.3 million is for general reserves. This is down by $10.7 million from $162.9 million, as of February 29, 2016.

According to the NCUA, the NCUSIF contingent liability is derived by using an internal econometric model that applies estimated failure and loss rates and takes into account the historical loss history, CAMEL ratings, credit union level financial ratios, and other conditions. In addition, specific analysis is performed on those insured credit unions where failure is imminent or where additional information is available that may affect the estimate of losses.

However, I believe NCUA may be underestimating the reserves needed to cover future losses to the NCUSIF, as past performance is not an indicator of future performance.

NCUA's internal econometric model might not accurately capture the estimated losses arising from the disruption of Uber and Lyft to taxi medallion lending credit unions.

The prices of taxi medallions -- the collateral backing the medallion loans -- have collapsed since the beginning of 2015.

This suggests that the loss rates to the NCUSIF from a failure of a taxi medallion lending credit union could be higher than past historical loss rates from other credit union failures.

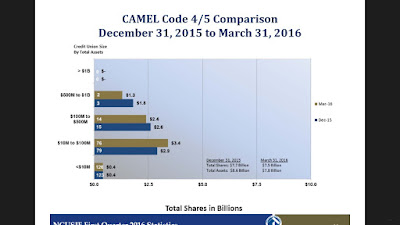

In addition, at the end of the first quarter, there was not a single credit union with assets of at least $1 billion in assets with a CAMEL rating of 4 or 5.

But that is a head scratcher, because there is one taxi medallion lending credit union with $1.9 billion in assets which has seen a clear deterioration in its performance.

Once again, this would suggest that reserves are understated.

So, are NCUSIF premium assessments in the offing?

According to the NCUA, the NCUSIF contingent liability is derived by using an internal econometric model that applies estimated failure and loss rates and takes into account the historical loss history, CAMEL ratings, credit union level financial ratios, and other conditions. In addition, specific analysis is performed on those insured credit unions where failure is imminent or where additional information is available that may affect the estimate of losses.

However, I believe NCUA may be underestimating the reserves needed to cover future losses to the NCUSIF, as past performance is not an indicator of future performance.

NCUA's internal econometric model might not accurately capture the estimated losses arising from the disruption of Uber and Lyft to taxi medallion lending credit unions.

The prices of taxi medallions -- the collateral backing the medallion loans -- have collapsed since the beginning of 2015.

This suggests that the loss rates to the NCUSIF from a failure of a taxi medallion lending credit union could be higher than past historical loss rates from other credit union failures.

In addition, at the end of the first quarter, there was not a single credit union with assets of at least $1 billion in assets with a CAMEL rating of 4 or 5.

But that is a head scratcher, because there is one taxi medallion lending credit union with $1.9 billion in assets which has seen a clear deterioration in its performance.

Once again, this would suggest that reserves are understated.

So, are NCUSIF premium assessments in the offing?

Labels:

Assessment,

Credit Union Failures,

NCUA,

NCUSIF,

Premiums

Subscribe to:

Post Comments (Atom)

This should be headline news in cus trade papers and is not.

ReplyDeleteThis should be a major concern for the trade associations and it is not.

Credit Unions, who has your back!

NCUA?

CUNA?

NAFCU?

CU TODAY?

CCUL?

NY CU League?