There are several other credit union failures, where non-member deposits were present, which suggests some linkage between non-member deposits and risk.

For example, HeritageWest FCU reported that non-member deposits went from zero in March 2007 to $52.1 million in March 2009. This expansion in non-member deposits supported rapid asset growth at the credit union with almost half of the credit union's asset growth funded by non-member deposits. At the time HeritageWest was closed, it reported $48 million in non-member deposits, which comprised over 17 percent of its total deposit base.

Norlarco Credit Union had the same pattern as non-member deposits went from zero as of September 2004 and peaked at $37.8 million as of March 2006. Once again, non-member deposits accounted for almost half of the credit union's growth during those 18 months.

At Cal State 9 Credit Union, non-member deposits grew to $48.9 million by June 2007 from zero at the end of 2004. Non-member deposits financed about a quarter of the the credit union's rapid asset growth.

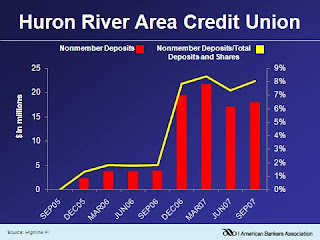

Huron River Area Credit Union also ramped up its holdings of non-member deposits going from zero to $21.7 million in less than 18 months.

This does raise the policy question about whether non-member deposits are a form of hot money fueling rapid asset growth.

If yes, then non-member deposits pose a safety and soundness concern, as rapid growth in non-member deposits can be associated with higher levels of credit risk and liquidity risk.

Keith,

ReplyDeleteAre you really known as "Mad Dog" Leggett around the water cooler at the ABA due to your "yipping" at CUs? (ABA Journal, July 2011, pg. 40)

If so WOW!....or maybe I should say BOW WOW!

Alarming statistical trend:

ReplyDeleteMore than 98 percent of convicted felons are bread users.

Fully HALF of all children who grow up in bread-consuming households score below average on standardized tests.

In the 18th century, when virtually all bread was baked in the home, the average life expectancy was less than 50 years; infant mortality rates were unacceptably high; many women died in childbirth; and diseases such as typhoid, yellow fever, and influenza ravaged whole nations.

More than 90 percent of violent crimes are committed within 24 hours of eating bread.

Bread is made from a substance called "dough." It has been proven that as little as one pound of dough can be used to suffocate a mouse. The average American eats more bread than that in one month!

Primitive tribal societies that have no bread exhibit a low incidence of cancer, Alzheimer's, Parkinson's disease, and osteoporosis.

Bread has been proven to be addictive. Subjects deprived of bread and given only water to eat begged for bread after as little as two days.

Bread is often a "gateway" food item, leading the user to "harder" items such as butter, jelly, peanut butter, and even cold cuts.

Newborn babies can choke on bread.

Bread is baked at temperatures as high as 400 degrees Fahrenheit. That kind of heat can kill an adult in less than one minute.

Applying the same logical approach to analyzing the connection between non-member deposits and credit union failures I find I must agree with the post. Non-member deposits do, in fact, contribute to credit union failures.

Good illustrations of spurious correlation.

ReplyDeleteHowever, FDIC's risk based pricing model incorporates rapid growth and excessive use of brokered deposits (hot money) as important variables in determining risk-based premiums.

Tom Glatt beat me to the punch on this one. This is yet another fine example of a writer clearly unaware that correlation and causation are two very different things.

ReplyDeleteIt is much to easy and tempting to blame non-member deposits for the failure of CUs and brokered deposits for failure of Banks. Unfortunately, the facts do not square up in either case. Le't all say it together: Businesses fail because of management mis-steps.