The National Credit Union Administration reported that the number of problem credit unions fell by 18 during the quarter to 258 credit unions at the end of the first quarter of 2015. There are 50 fewer problem credit unions compared to a year ago.

A problem credit union has a CAMEL rating of 4 or 5.

Problem credit unions held $10.3 billion in shares (deposits) and $11.6 billion in assets at the end of the first quarter of 2015. In comparison, shares and assets at problem credit unions were $10.2 billion and $11.5 billion at the end of 2014, respectively.

Shares at problem credit unions equaled 1.14 percent of the industry's insured shares and approximately 1 percent of the industry's assets.

The number of problem credit unions with $500 million or more in assets was unchanged at 5 during the quarter; but shares rose by $100 million to $4 billion.

The number of problem credit unions with assets between $100 million and $500 million increased by 2 during the quarter to 17 credit unions. Shares at these problem credit unions increased from $2.9 billion to $3.2 billion during the quarter.

The number of problem credit unions with $100 million or less in assets fell during the quarter, as did shares.

Thursday, April 30, 2015

Tuesday, April 28, 2015

Secure First CU Placed Under Cease & Desist Order

The Alabama Credit Union Administration on March 17 placed Secure First Credit Union under a cease and desist order for unsafe and unsound practices and violation of the law, rule, and regulation.

The order notes that the Birmingham-based credit union failed to satisfy requirements set forth in an August 5, 2013 Letter of Understanding and Agreement and had not addressed numerous outstanding Document of Resolution in Examination Reports.

The $44.6 million credit union was cited for unsafe and unsound lending practices, including insider loans that did not adhere to lending guidelines; deficiencies in its allowance for loan and lease losses account; and inadequate compliance program, including non-compliance in BSA/AML area.

Read the order.

The order notes that the Birmingham-based credit union failed to satisfy requirements set forth in an August 5, 2013 Letter of Understanding and Agreement and had not addressed numerous outstanding Document of Resolution in Examination Reports.

The $44.6 million credit union was cited for unsafe and unsound lending practices, including insider loans that did not adhere to lending guidelines; deficiencies in its allowance for loan and lease losses account; and inadequate compliance program, including non-compliance in BSA/AML area.

Read the order.

Saturday, April 25, 2015

Impermissible Investment Losses at TVA Community CU

The TimesDaily.com is reporting on possible impermissible investment losses at TVA Community Credit Union.

A September 2014 e-mail from the National Credit Union Administration notes that the agency was monitoring these impermissible investments by the Muscle Shoals-based credit union.

Read the story.

A September 2014 e-mail from the National Credit Union Administration notes that the agency was monitoring these impermissible investments by the Muscle Shoals-based credit union.

Read the story.

Friday, April 24, 2015

Alabama One CU Under Cease & Desist Order

The order, which was issued on April 2, found that Institution-Affiliated Parties at $602 million Alabama One Credit Union had engaged in unsafe and unsound practices.

The enforcement order found that the Board of Directors had failed to provide adequate supervision over and direction to the management of the credit union.

In addition, the credit union operated with inadequate management.

The enforcement order also stated that the credit union operated without proper expertise, policies and procedures with regard to its Member Business Loan (MBL) portfolio.

Furthermore, the credit union had unsafe and unsound loan underwriting and administration practices.

The state regulator found that the credit union granted, renewed, and extended loans to members disguised as straw borrowers. The credit union also modified, extended, deferred, and renewed business loans to a borrower who did not have ability to meet the terms of the loan.

Within sixty days of the order becoming effective, the credit union is to retain qualified management, including CEO, COO, and senior lending officer.

The credit union is required to charge-off those loans classified as a loss. Also, the credit union will cease offering, granting, and issuing MBLs.

Read the Order.

The enforcement order found that the Board of Directors had failed to provide adequate supervision over and direction to the management of the credit union.

In addition, the credit union operated with inadequate management.

The enforcement order also stated that the credit union operated without proper expertise, policies and procedures with regard to its Member Business Loan (MBL) portfolio.

Furthermore, the credit union had unsafe and unsound loan underwriting and administration practices.

The state regulator found that the credit union granted, renewed, and extended loans to members disguised as straw borrowers. The credit union also modified, extended, deferred, and renewed business loans to a borrower who did not have ability to meet the terms of the loan.

Within sixty days of the order becoming effective, the credit union is to retain qualified management, including CEO, COO, and senior lending officer.

The credit union is required to charge-off those loans classified as a loss. Also, the credit union will cease offering, granting, and issuing MBLs.

Read the Order.

Ascend FCU Buys Naming Rights to Nashville Amphitheater

Tullahoma-based Ascend Federal Credit Union has bought the naming rights to the West Riverfront Park amphitheater in Nashville.

The venue will be known as Ascend Amphitheater.

The amphitheater can hold up to 6,800 people and will open July 30.

The deal is for 10 years. However financial terms were not disclosed.

The buying of naming rights to arenas by credit unions is becoming a regular occurrence, but in my opinion represents an abuse of the credit union tax exemption.

Read the article.

The venue will be known as Ascend Amphitheater.

The amphitheater can hold up to 6,800 people and will open July 30.

The deal is for 10 years. However financial terms were not disclosed.

The buying of naming rights to arenas by credit unions is becoming a regular occurrence, but in my opinion represents an abuse of the credit union tax exemption.

Read the article.

Thursday, April 23, 2015

Montgomery County CU Conserved (Updated)

The Superintendent of the Ohio Division of Financial Institutions today placed Montgomery County Credit Union, Inc., located in Dayton, Ohio, into conservatorship and appointed the National Credit Union Administration (NCUA) as agent for the conservator.

The Ohio Division of Financial Institutions wrote:

Montgomery County Credit Union has reported losses of $393,139 and $380,685 for 2013 and 2014, respectively. In addition, the delinquency ratio for the credit union rose during the second half of 2014 from 0.69 percent to 2.53 percent.

According to the Dayton Daily News, "[i]n 2013, the credit union was investigated for allegations of poor management and mishandled money that was found during an ongoing audit. The board of directors of Montgomery County Credit Union Inc. told members that the problems led to an approximately $1.3 million net loss in 2012.

Montgomery County Credit Union, Inc., is a federally insured, state-chartered credit union with 6,605 members and $27.3 million in assets, according to the credit union’s most recent Call Report.

Go to the Ohio Division of Financial Institutions website to read the press release.

Read the NCUA press release.

The Ohio Division of Financial Institutions wrote:

"Over the last several years, the Division has been working closely with the credit union in order to prevent

its financial condition from deteriorating. Unfortunately, certain safety and soundness concerns were not resolved in a timely fashion, and it became necessary for the Division to take action to protect the assets of the credit union for members, depositors and creditors."

Montgomery County Credit Union has reported losses of $393,139 and $380,685 for 2013 and 2014, respectively. In addition, the delinquency ratio for the credit union rose during the second half of 2014 from 0.69 percent to 2.53 percent.

According to the Dayton Daily News, "[i]n 2013, the credit union was investigated for allegations of poor management and mishandled money that was found during an ongoing audit. The board of directors of Montgomery County Credit Union Inc. told members that the problems led to an approximately $1.3 million net loss in 2012.

Montgomery County Credit Union, Inc., is a federally insured, state-chartered credit union with 6,605 members and $27.3 million in assets, according to the credit union’s most recent Call Report.

Go to the Ohio Division of Financial Institutions website to read the press release.

Read the NCUA press release.

CUNA's Alternative Universe

In reading the risk-based capital comment letter from the Credit Union National Association (CUNA), I came to the conclusion that this trade association is operating in an alternative universe from the rest of us.

CUNA writes:

However, this comment by CUNA is disingenuous.

It fails to take into consideration that the cost of the corporate credit union debacle was transferred from the NCUSIF to the Temporary Corporate Credit Union Stabilization Fund (TCCUSF).

If the losses from the corporate credit union debacle stayed with the NCUSIF, the equity ratio would have fallen to 0.11 percent of insured deposits, according to NCUA analysis. This would have been well below the normal operating level set in law for the NCUSIF.

In addition, credit unions paid $4.8 billion in assessments to the TCCUSF.

Maybe in CUNA's alternative universe, the corporate credit union fiasco did not happen. But for the rest of us with our feet firmly planted in reality, we know that without the corporate credit union bailout, the NCUSIF equity ratio would have fallen sharply below the normal operating level.

CUNA writes:

"From 2008 to 2012 the NCUSIF fund balance never fell below its historical range of 1.2% to 1.3% of insured deposits, despite the failures of 124 credit unions. This stability in the fund ratio was accomplished with just two share insurance premiums, in 2009 and 2010, totaling 24 basis points of insured shares."

However, this comment by CUNA is disingenuous.

It fails to take into consideration that the cost of the corporate credit union debacle was transferred from the NCUSIF to the Temporary Corporate Credit Union Stabilization Fund (TCCUSF).

If the losses from the corporate credit union debacle stayed with the NCUSIF, the equity ratio would have fallen to 0.11 percent of insured deposits, according to NCUA analysis. This would have been well below the normal operating level set in law for the NCUSIF.

In addition, credit unions paid $4.8 billion in assessments to the TCCUSF.

Maybe in CUNA's alternative universe, the corporate credit union fiasco did not happen. But for the rest of us with our feet firmly planted in reality, we know that without the corporate credit union bailout, the NCUSIF equity ratio would have fallen sharply below the normal operating level.

Wednesday, April 22, 2015

Meriwest CU Sponsors Major League Soccer Team

Meriwest Credit Union (San Jose, CA) announced that it has signed a three-year agreement with the San Jose Earthquakes to become the Official Credit Union sponsor of the Major League Soccer team.

As part of the sponsorship with the San Jose Earthquakes, Meriwest Credit Union will receive significant signage rights throughout the exterior and interior of the new Avaya stadium.

The price of the sponsorship was not disclosed.

As part of the sponsorship with the San Jose Earthquakes, Meriwest Credit Union will receive significant signage rights throughout the exterior and interior of the new Avaya stadium.

The price of the sponsorship was not disclosed.

Tuesday, April 21, 2015

List of CUs that Would See An Increase in Share of NCUSIF Assessment Base

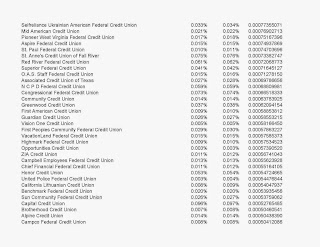

Below is a list of the 456 credit unions that would see an increase in their portion of the NCUSIF assessment base, if the assessment base shifted from insured shares and deposits to total assets minus net worth. The credit unions are ranked by largest change in share of NCUSIF assessment base (click on images to enlarge).

Monday, April 20, 2015

Matz: NCUA Not Participating in Operation Choke Point

In an April 15 letter to House Financial Services Chairman Jeb Hensarling, NCUA Chairman Debbie Matz stated that the agency "has not and will not participate in Operation Choke Point or any similar operation."

Matz also wrote that the agency does not dictate to credit unions, which businesses they serve, as long as the businesses are legal and within the credit union's field of membership.

Read the letter below.

Matz also wrote that the agency does not dictate to credit unions, which businesses they serve, as long as the businesses are legal and within the credit union's field of membership.

Read the letter below.

Friday, April 17, 2015

Nusenda FCU Buys Naming Rights to Football Stadium

The Albuquerque Public Schools Foundation and Nusenda Federal Credit Union finalized a deal regarding the naming rights to Community Stadium.

The football stadium is now officially named Nusenda Credit Union Community Stadium.

In exchange for the naming rights the credit union will pay the APS school foundation $79,800 annually over the next eight years for the naming rights.

Read the story.

The football stadium is now officially named Nusenda Credit Union Community Stadium.

In exchange for the naming rights the credit union will pay the APS school foundation $79,800 annually over the next eight years for the naming rights.

Read the story.

Thursday, April 16, 2015

Oregon State Credit Union Breaks Ground on New $18 Million HQ Building

Oregon State Credit Union (Corvallis, OR) broke ground this week on a new $18 million, three-story, 62,000-square-foot headquarters building.

Work on the new building is getting underway as the credit union transitions from a federal to state charter and will see an expansion of its service area from 5 Oregon counties to as many as 24 Oregon counties.

Read the story.

Work on the new building is getting underway as the credit union transitions from a federal to state charter and will see an expansion of its service area from 5 Oregon counties to as many as 24 Oregon counties.

Read the story.

Mergers and Net Worth Adjustments

Recently, Pepsico Employees Federal Credit Union (White Plains, NY) was merged into larger USAlliance Federal Credit Union (Rye, NY).

The rationale for the merger was expanded services.

However, what was not disclosed was whether the 3,567 members of Pepsico Employees FCU received any net worth adjustment.

According to the December 2014 call reports, Pepsico Employees FCU had a higher net worth ratio than USAlliance FCU -- 13.95 percent versus 8.57. This is a difference of 538 basis points.

If the combined institution's net worth ratio was maintained at 8.57 percent, then the members of Pepsico Employees FCU should have received approximately $1.92 million net worth payment or slightly more than $65 per $1000 deposited at the credit union.

An e-mail to USAlliance FCU about whether a net worth adjustment was part of the merger agreement was not answered.

I don't know how prevalent such net worth adjustments are when credit unions merge; but if a credit union that merges into another has a higher net worth ratio, then its members should benefit by getting back a portion of the credit union's net worth.

The rationale for the merger was expanded services.

However, what was not disclosed was whether the 3,567 members of Pepsico Employees FCU received any net worth adjustment.

According to the December 2014 call reports, Pepsico Employees FCU had a higher net worth ratio than USAlliance FCU -- 13.95 percent versus 8.57. This is a difference of 538 basis points.

If the combined institution's net worth ratio was maintained at 8.57 percent, then the members of Pepsico Employees FCU should have received approximately $1.92 million net worth payment or slightly more than $65 per $1000 deposited at the credit union.

An e-mail to USAlliance FCU about whether a net worth adjustment was part of the merger agreement was not answered.

I don't know how prevalent such net worth adjustments are when credit unions merge; but if a credit union that merges into another has a higher net worth ratio, then its members should benefit by getting back a portion of the credit union's net worth.

Wednesday, April 15, 2015

Distributional Impact of Changing Assessment Base.

In the NCUA's White Paper on National Credit Union Share Insurance Fund Improvements, the agency proposed changing the assessment base from insured shares and deposits to total assets minus net worth. Read my April 6 blog.

If this proposal was to become law, only 456 natural person credit unions would see their portion of the NCUSIF assessment base increase as of the end of 2014. This would mean these credit unions would pay higher deposit insurance premiums, if assessed and the aggregate premium payments are revenue neutral.

All other credit unions would either see a reduction or no change in their share of the NCUSIF assessment base.

Below is an analysis of credit unions by asset size that would see an increase their share of the NCUSIF assessment base.

Two credit unions with more than $10 billion in assets would see their portion of the NCUSIF assessment base increase with the change.

Eleven credit unions with assets between $5 billion and $10 billion would experience an increase in their portion of the NCUSIF assessment base.

For credit unions with assets between $1 billion and $5 billion, 86 credit unions would encounter an increase in their share of the NCUSIF assessment base.

The portion of the assessment base for 63 credit unions with assets between $500 million and $1 billion would increase.

Sixty-two credit unions with assets between $250 million and $500 million would experience an increase in their share of the assessment base.

For credit unions with between $100 million and $250 million, 85 would see their portion of the assessment base grow.

Finally, 147 small credit union would see an increase in their share of the NCUSIF assessment base.

If this proposal was to become law, only 456 natural person credit unions would see their portion of the NCUSIF assessment base increase as of the end of 2014. This would mean these credit unions would pay higher deposit insurance premiums, if assessed and the aggregate premium payments are revenue neutral.

All other credit unions would either see a reduction or no change in their share of the NCUSIF assessment base.

Below is an analysis of credit unions by asset size that would see an increase their share of the NCUSIF assessment base.

Two credit unions with more than $10 billion in assets would see their portion of the NCUSIF assessment base increase with the change.

Eleven credit unions with assets between $5 billion and $10 billion would experience an increase in their portion of the NCUSIF assessment base.

For credit unions with assets between $1 billion and $5 billion, 86 credit unions would encounter an increase in their share of the NCUSIF assessment base.

The portion of the assessment base for 63 credit unions with assets between $500 million and $1 billion would increase.

Sixty-two credit unions with assets between $250 million and $500 million would experience an increase in their share of the assessment base.

For credit unions with between $100 million and $250 million, 85 would see their portion of the assessment base grow.

Finally, 147 small credit union would see an increase in their share of the NCUSIF assessment base.

Tuesday, April 14, 2015

Bill Giving Privately Insured CUs Access to FHLBs Passes House

The Capital Access for Community Financial Institutions Act of 2015 (H.R. 299) passed the House of Representatives by a voice vote on Monday.

The bill would allow privately insured credit unions to join the Federal Home Loan Bank (FHLB) system.

The bill would allow privately insured credit unions to join the Federal Home Loan Bank (FHLB) system.

Monday, April 13, 2015

Who Should Pay Associational Dues?

The National Credit Union Administration in its proposed associational common bond rule states that a federal credit union (FCU) "may pay a member’s associational dues if the member has given consent."

However, it seems to me that most, if not all, members would give their consent to an FCU paying their associational dues.

The paying of dues by the member, not the FCU, would show that the member to some degree supports the goals and mission of the association and that they are not just joining the association for the purpose of becoming a member of an FCU.

This payment of dues by the member should be a requirement for fulfilling the totality of the circumstances test for an associational common bond.

However, it seems to me that most, if not all, members would give their consent to an FCU paying their associational dues.

The paying of dues by the member, not the FCU, would show that the member to some degree supports the goals and mission of the association and that they are not just joining the association for the purpose of becoming a member of an FCU.

This payment of dues by the member should be a requirement for fulfilling the totality of the circumstances test for an associational common bond.

Friday, April 10, 2015

Federal Reserve Discount Window Borrowings by CUs, Q1 2013

The Federal Reserve recently released first quarter 2013 data on credit union and bank borrowings from the Federal Reserve's discount window.

The following tables look at individual transactions by credit unions during the first quarter.

The following tables look at individual transactions by credit unions during the first quarter.

Wednesday, April 8, 2015

Report: Oregon CUs Poor Record of Mortgages to Low-Income Borrowers

A report analyzing Oregon credit unions’ mortgage lending found the industry made 11,775 home mortgage loans in 2013, but less than one percent – 96 mortgages - went to low-income households.

Credit unions were granted non-profit, tax-exempt status in order to serve persons of “modest means,” but recently released Home Mortgage Disclosure Act data is calling that mission into question.

According to the report,

Read the report.

Credit unions were granted non-profit, tax-exempt status in order to serve persons of “modest means,” but recently released Home Mortgage Disclosure Act data is calling that mission into question.

According to the report,

- Of the 11,775 mortgages originated by Oregon credit unions last year, less than one percent – 96 mortgages - went to low-income borrowers - less than one percent. 14 percent went to moderate income; 53 percent went to middle income; 32 percent went to upper income.

- Oregon credit unions made 18 mortgage loans on homes of $1 million or more. OnPoint Community Credit Union, the state’s largest credit union, made four mortgage loans on homes of $1 million or more.

- Oregon’s five largest credit unions averaged only one percent of their mortgage originations to low-income individuals.

- There were seven Oregon credit unions that originated loans to ONLY upper income individuals.

Read the report.

Tuesday, April 7, 2015

Elements Financial CU Buys Naming Rights to Pavilion at Indiana State Fairgrounds

Elements Financial, formerly Eli Lilly Federal Credit Union, was announced as the official title sponsor of the Blue Ribbon Pavilion on the Indiana State Fairgrounds.

The sponsorship is for five-years. However, the cost of the sponsorship was not disclosed for the 70,575 square foot building.

Read the story.

The sponsorship is for five-years. However, the cost of the sponsorship was not disclosed for the 70,575 square foot building.

Read the story.

Monday, April 6, 2015

NCUA White Paper on Reforming the NCUSIF

A September 2013 NCUA White Paper sets forth the agency's recommendations for improving the National Credit Union Share Insurance Fund.

According to the White Paper, which was obtained through a Freedom of Information Act request, the National Credit Union Administration (NCUA) made the case for reform by stating that under current law it "does not have the appropriate flexibility necessary to manage the National Credit Union Share Insurance Fund (NCUSIF) in a manner consistent with the growing size and complexity of the credit union industry."

The 2013 White Paper made the following legislative recommendations to Congress.

Congress should approve legislation to remove the statutory cap from the NCUSIF equity ratio. Under current law, the normal operating level is set between 1.2 percent and 1.5 percent of insured shares (deposits) with the NCUA Board traditionally setting the normal operating level at 1.3 percent of insured shares. However, the agency has concluded that going forward a 1.3 percent equity ratio for the NCUSIF cannot be viewed as normal. The NCUA believes that "the NCUSIF needs an equity ratio of at least 2 percent to provide an asset base that would better enable the NCUSIF to withstand the types of pressure that arose during the recent financial crisis and recession." The agency estimated that the NCUSIF equity ratio needed to be at 2.17 percent of insured shares to prevent any depletion of a credit union's one percent NCUSIF capitalization deposit during the recent financial crisis and recession. In fact, I stated that this would be one possible NCUSIF reform in a January 8, 2014 blog post.

Congress should also amend the Federal Credit Union Act to enable NCUA to calculate premiums paid by insured credit unions based on assets minus net worth, rather than insured shares. NCUA wrote that basing premiums on total assets minus net worth would better account for the risks posed by highly leveraged institutions. The implication of shifting premiums to an asset minus net worth assessment base is that the share of premiums paid by larger credit unions and corporate credit unions would increase, while the premium burden for credit unions with less than $1 billion in assets would fall.

Furthermore, Congress should change the Federal Credit Union Act to enable the NCUA Board to develop a risk-based premium system for credit unions. Under current law, NCUA is required to assess NCUSIF premiums using a uniform percentage applied to the amount of insured deposits held by a credit union. NCUA wrote that by moving from a proportional to a risk-based premium system, this would increase both fairness and incentives for operating safely. In addition, the proposed legislative language submitted by NCUA would allow the Board to establish a different risk-based premium system for credit unions defined as small. However, the White Paper does not specify how the risk-based premiums will be calculated.

According to the White Paper, which was obtained through a Freedom of Information Act request, the National Credit Union Administration (NCUA) made the case for reform by stating that under current law it "does not have the appropriate flexibility necessary to manage the National Credit Union Share Insurance Fund (NCUSIF) in a manner consistent with the growing size and complexity of the credit union industry."

The 2013 White Paper made the following legislative recommendations to Congress.

Congress should approve legislation to remove the statutory cap from the NCUSIF equity ratio. Under current law, the normal operating level is set between 1.2 percent and 1.5 percent of insured shares (deposits) with the NCUA Board traditionally setting the normal operating level at 1.3 percent of insured shares. However, the agency has concluded that going forward a 1.3 percent equity ratio for the NCUSIF cannot be viewed as normal. The NCUA believes that "the NCUSIF needs an equity ratio of at least 2 percent to provide an asset base that would better enable the NCUSIF to withstand the types of pressure that arose during the recent financial crisis and recession." The agency estimated that the NCUSIF equity ratio needed to be at 2.17 percent of insured shares to prevent any depletion of a credit union's one percent NCUSIF capitalization deposit during the recent financial crisis and recession. In fact, I stated that this would be one possible NCUSIF reform in a January 8, 2014 blog post.

Congress should also amend the Federal Credit Union Act to enable NCUA to calculate premiums paid by insured credit unions based on assets minus net worth, rather than insured shares. NCUA wrote that basing premiums on total assets minus net worth would better account for the risks posed by highly leveraged institutions. The implication of shifting premiums to an asset minus net worth assessment base is that the share of premiums paid by larger credit unions and corporate credit unions would increase, while the premium burden for credit unions with less than $1 billion in assets would fall.

Furthermore, Congress should change the Federal Credit Union Act to enable the NCUA Board to develop a risk-based premium system for credit unions. Under current law, NCUA is required to assess NCUSIF premiums using a uniform percentage applied to the amount of insured deposits held by a credit union. NCUA wrote that by moving from a proportional to a risk-based premium system, this would increase both fairness and incentives for operating safely. In addition, the proposed legislative language submitted by NCUA would allow the Board to establish a different risk-based premium system for credit unions defined as small. However, the White Paper does not specify how the risk-based premiums will be calculated.

Friday, April 3, 2015

Mazuma CU Sponsors Kansas City Pro Soccer Team

Mazuma Credit Union signed a five-year sponsorship agreement with Major League Soccer's Sporting Kansas City.

Mazuma is constructing at Sporting Park the Mazuma Mezzanine, a hexagonal area that will look like a soccer ball and allow fans to sit down and watch the game while they get a drink or a snack. Mazuma is also running Sporting Kansas City's affinity card program.

The value of the deal was not disclosed.

As I have written previously, the credit union tax exemption is not meant to fund such sponsorship deals.

Read the article.

Mazuma is constructing at Sporting Park the Mazuma Mezzanine, a hexagonal area that will look like a soccer ball and allow fans to sit down and watch the game while they get a drink or a snack. Mazuma is also running Sporting Kansas City's affinity card program.

The value of the deal was not disclosed.

As I have written previously, the credit union tax exemption is not meant to fund such sponsorship deals.

Read the article.

Thursday, April 2, 2015

Ent FCU Extends Agreement with UCCS and Gets Naming Rights to Performing Arts Venue

Ent Federal Credit Union (FCU) and the University of Colorado Colorado Springs (UCCS) have extended their current marketing and operating agreement for 15 years, which is valued at $12.6 million.

As part of the agreement, Ent FCU received naming rights for the soon to be constructed UCCS visual and performing arts venue, which will be named the Ent Center for the Arts.

Read the press release.

As part of the agreement, Ent FCU received naming rights for the soon to be constructed UCCS visual and performing arts venue, which will be named the Ent Center for the Arts.

Read the press release.

Wednesday, April 1, 2015

North Dade Community Development FCU Closed

The National Credit Union Administration (NCUA) on March 31 liquidated North Dade Community Development Federal Credit Union (North Dade) of Miami Gardens, Florida.

NCUA made the decision to liquidate North Dade Community Development Federal Credit Union and discontinue operations after determining the credit union had violated various provisions of its charter, bylaws and federal regulations.

In November 2014, North Dade was fined $300,000 by the Financial Crimes Enforcement Network for violation of the Bank Secrecy Act (BSA).

North Dade reported a loss of $672,414 for 2014.

This is the second credit union to be liquidated in 2015.

Read the press release.

NCUA made the decision to liquidate North Dade Community Development Federal Credit Union and discontinue operations after determining the credit union had violated various provisions of its charter, bylaws and federal regulations.

In November 2014, North Dade was fined $300,000 by the Financial Crimes Enforcement Network for violation of the Bank Secrecy Act (BSA).

North Dade reported a loss of $672,414 for 2014.

This is the second credit union to be liquidated in 2015.

Read the press release.

Losing Their Mutuality

Some credit unions are losing their mutuality.

Several weeks ago I wrote about a bill (SB 582) in Oregon that would remove the requirement that an individual open a share account as a condition of credit union membership.

The justification for this provision is that it is costly for a credit union to maintain share accounts and the share account serves no purpose for the member.

Washington-state also does not require a person open a share account for credit union membership.

But allowing a person to join a credit union through solely a credit relationship undermines the concept of mutuality -- that borrowers and depositors are the same individual.

Moreover, I have seen some federal credit unions' credit solicitations that stated that the institutions would pay to open the share account for membership.

Once again, this appears to violate the principle of mutuality.

It seems that credit unions are following the same slippery path as the thrift industry.

One of the reasons cited by Congress in 1951 for removing the thrift tax exemption was that these institutions had had lost their “mutuality,” in the sense that the institutions’ borrowers and depositors were not necessarily the same individuals.

Several weeks ago I wrote about a bill (SB 582) in Oregon that would remove the requirement that an individual open a share account as a condition of credit union membership.

The justification for this provision is that it is costly for a credit union to maintain share accounts and the share account serves no purpose for the member.

Washington-state also does not require a person open a share account for credit union membership.

But allowing a person to join a credit union through solely a credit relationship undermines the concept of mutuality -- that borrowers and depositors are the same individual.

Moreover, I have seen some federal credit unions' credit solicitations that stated that the institutions would pay to open the share account for membership.

Once again, this appears to violate the principle of mutuality.

It seems that credit unions are following the same slippery path as the thrift industry.

One of the reasons cited by Congress in 1951 for removing the thrift tax exemption was that these institutions had had lost their “mutuality,” in the sense that the institutions’ borrowers and depositors were not necessarily the same individuals.