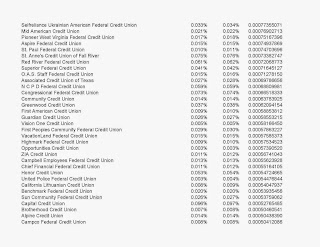

Below is a list of the 456 credit unions that would see an increase in their portion of the NCUSIF assessment base, if the assessment base shifted from insured shares and deposits to total assets minus net worth. The credit unions are ranked by largest change in share of NCUSIF assessment base (click on images to enlarge).

Doc,

ReplyDeleteSorry about that last comment appearing under the wrong post...

Will you help confirm that although only 453 CUs will see their "portion" of the fund increase, that almost all CUs will have an increase in premium?

Here's the unscientific guess (the approach NCUA quants most often use!): Historically "on average" most credit unions had about 10-15% of shares in accts. over $100k and therefore uninsured (no premium deposit). Even with move to $250k "on average" CUs have 8-10% of shares in large uninsured accts.

Using the "on average" 10% in uninsured, $250k+ acct estimate, then on average all CUs are going to pay an add'l 10% premium/deposit to NCUSIF for those accts given the new "assets - net worth formula"? Comprendez?

If correct, that means NCUA will have CUs paying an insurance premium/deposit on accts that are uninsured... got to love it, "an uninsured deposit insurance premium"!

CU folks now call that kind of NCUA "logic" a "larry"!

Actually higher premia for almost everybody - right??

Jim:

ReplyDeleteMy analysis was based upon being revenue neutral. Under that scenario, only 453 would see an increase in their share of the assessment base.

If NCUA charges the same premium of 1/12th of one percent, most CUs would see an increase in their insurance assessment. But this would not be revenue neutral.

The other thing to take into consideration is whether NCUA gets legislation to put in place a risk-based premium system. That would also shift the amount paid.