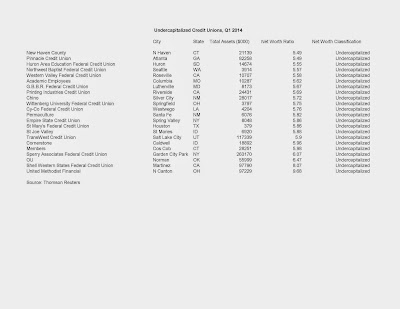

Sixty-three credit unions were undercapitalized at the end of the first quarter of 2014. This was an increase of two credit unions from the end of 2013; but down 31 credit unions from a year ago.

The 63 undercapitalized credit unions reported slightly more than $3.5 billion in assets at the end of the first quarter of 2014.

Four credit unions were critically undercapitalized. Another 13 credit unions were significantly undercapitalized.

Although four credit unions had net worth leverage ratios in excess of 6 percent, their risk-based net worth ratios indicated that they were undercapitalized.

No comments:

Post a Comment