The National Credit Union Administration reported that there were 295 problem credit unions at the end of the second quarter of 2014 -- a decline of 11 from the end of the first quarter.

A problem credit union has a CAMEL Code of 4 or 5.

However, the assets and shares (deposits) in problem credit unions rose during the quarter. At the end of the first quarter, total shares and assets in problem credit unions were $11.9 billion and $13.6 billion, respectively. By the end of the second quarter, total assets and shares in problem credit unions had increased to $13.2 billion and $14.9 billion, respectively.

As of June 30, 2014, 1.46 percent of the industry's insured shares and 1.4 percent of assets were in problem credit unions.

While the number of problem credit unions fell, it was among credit unions with less than $100 million in assets. Credit unions with between $100 million and $500 million saw an additional 5 credit unions join the problem list, bringing the total to 19 credit unions. The number of problem credit unions with assets between $500 million and $1 billion rose by one to 5 during the quarter.

Thursday, July 31, 2014

Wednesday, July 30, 2014

Bensenville Community Credit Union Insolvent, Operations Temporarily Suspended

The Illinois Division of Financial Institutions has suspended the operations of Bensenville Community Credit Union after determining the credit union was insolvent.

As of May 31, 2014, the credit union was insolvent with total liabilities and shares of $14,438,508.11 and net assets of $14,429,853.91 resulting in total net worth of negative $8,654.20.

According to its June 30th financial statement, the credit union reported a loss of $340,099 for the first six months of 2014.

The Illinois CU regulator suspended the operation of the credit union for 60 days.

Bensenville Community Credit Union is privately insured.

Read the order.

As of May 31, 2014, the credit union was insolvent with total liabilities and shares of $14,438,508.11 and net assets of $14,429,853.91 resulting in total net worth of negative $8,654.20.

According to its June 30th financial statement, the credit union reported a loss of $340,099 for the first six months of 2014.

The Illinois CU regulator suspended the operation of the credit union for 60 days.

Bensenville Community Credit Union is privately insured.

Read the order.

Tuesday, July 29, 2014

HMDA Proposal Would Increase Reporting Burden

The Consumer Financial Protection Bureau (CFPB) has issued a 573-page proposed rule that would significantly increase the reporting burden on Home Mortgage Disclosure Act (HMDA) filers.

The proposed rule would mandate financial institutions to report 37 new additional data fields under HMDA. In keeping with the Dodd-Frank Act requirements, the rule would require lenders to report for the first time property value, loan term, total points and fees, the duration of teaser rates and the age and credit score of the applicant or borrower. The CFPB also proposed that lenders submit data on an applicant’s debt-to-income ratio, interest rate and total points charged, which the bureau said would help it evaluate the impact of its mortgage rules. With only a few exceptions, all dwelling-secured loans would be subject to the rule.

The CFPB further proposed a single threshold -- 25 mortgages originated annually, excluding open-end lines of credit -- at which financial institutions become subject to the rule. The CFPB estimates that approximately 1600 depository institutions would no longer be subject to HMDA reporting, while almost 450 nondepository institutions would now have to report their HMDA data.

In addition, financial institutions that reported at least 75,000 covered loans, applications, and purchased covered loans, combined, for the preceding calendar year, would be required to report data quarterly. THE CFPB estimates 28 financial institutions would be subject to the new quarterly reporting requirements based on 2012 HMDA data.

While the proposal would reduce the reporting burden on banks and credit unions that originate few mortgages, for all other banks and credit unions the reporting burden will significantly increase.

The proposed rule would mandate financial institutions to report 37 new additional data fields under HMDA. In keeping with the Dodd-Frank Act requirements, the rule would require lenders to report for the first time property value, loan term, total points and fees, the duration of teaser rates and the age and credit score of the applicant or borrower. The CFPB also proposed that lenders submit data on an applicant’s debt-to-income ratio, interest rate and total points charged, which the bureau said would help it evaluate the impact of its mortgage rules. With only a few exceptions, all dwelling-secured loans would be subject to the rule.

The CFPB further proposed a single threshold -- 25 mortgages originated annually, excluding open-end lines of credit -- at which financial institutions become subject to the rule. The CFPB estimates that approximately 1600 depository institutions would no longer be subject to HMDA reporting, while almost 450 nondepository institutions would now have to report their HMDA data.

In addition, financial institutions that reported at least 75,000 covered loans, applications, and purchased covered loans, combined, for the preceding calendar year, would be required to report data quarterly. THE CFPB estimates 28 financial institutions would be subject to the new quarterly reporting requirements based on 2012 HMDA data.

While the proposal would reduce the reporting burden on banks and credit unions that originate few mortgages, for all other banks and credit unions the reporting burden will significantly increase.

Monday, July 28, 2014

Going POSTAL Act

Like a bad penny, the idea of the Post Office offering banking services is being resurrected.

Between 1910 and 1967, the U.S. Post Office offered banking services. However by the 1950s, the need for the Postal Savings System was being questioned and in 1965 the Postmaster General recommended abolishing the system.

But on July 16th of this year, the Pew Charitable Trust hosted an event on whether the Post Office should offer financial services.

Senator Elizabeth Warren spoke at the event and has become a vocal champion of postal banking. For example in U.S. News, Senator Warren argued that allowing the post office to offer affordable banking services would be a win for underserved families and it would also shore up the finances of the Post Office. She pointed out that the Post Office already provides some financial services, like international money transfers to certain countries and domestic money orders. (Click here to read the op ed)

On July 24th, Rep. Cedric Richmond (D-La.) introduced a bill, The Providing Opportunities for Savings, Transactions and Lending Act – or the POSTAL Act, that would allow the U.S. Postal Service to provide an expanded range of financial products -- including checking accounts, interest-bearing savings accounts, small-dollar loans, debit cards and international money transfers. In addition to these products, which are explicitly mentioned in the bill, Richmond would allow USPS to offer “such other basic financial services as the Postal Service determines appropriate in the public interest.”

The danger to banks and credit unions is that this new postal savings bank could be perceived by many as a government-endorsed and preferred provider of financial products and the last thing we need is more government competition with the private sector.

Between 1910 and 1967, the U.S. Post Office offered banking services. However by the 1950s, the need for the Postal Savings System was being questioned and in 1965 the Postmaster General recommended abolishing the system.

But on July 16th of this year, the Pew Charitable Trust hosted an event on whether the Post Office should offer financial services.

Senator Elizabeth Warren spoke at the event and has become a vocal champion of postal banking. For example in U.S. News, Senator Warren argued that allowing the post office to offer affordable banking services would be a win for underserved families and it would also shore up the finances of the Post Office. She pointed out that the Post Office already provides some financial services, like international money transfers to certain countries and domestic money orders. (Click here to read the op ed)

On July 24th, Rep. Cedric Richmond (D-La.) introduced a bill, The Providing Opportunities for Savings, Transactions and Lending Act – or the POSTAL Act, that would allow the U.S. Postal Service to provide an expanded range of financial products -- including checking accounts, interest-bearing savings accounts, small-dollar loans, debit cards and international money transfers. In addition to these products, which are explicitly mentioned in the bill, Richmond would allow USPS to offer “such other basic financial services as the Postal Service determines appropriate in the public interest.”

The danger to banks and credit unions is that this new postal savings bank could be perceived by many as a government-endorsed and preferred provider of financial products and the last thing we need is more government competition with the private sector.

Friday, July 25, 2014

Prudent Capital Management Should Include a Buffer

In case you missed it, credit unions should read NCUA Board member Rick Metsger's column in the July 2014 NCUA Report.

Metsger believes that prudent capital management should include a capital buffer above the minimum requirement for being well-capitalized.

Metsger wrote:

So while Metsger is trying to tell most credit unions covered by the proposed rule that they are holding more than enough capital and should not worry about the proposed risk-based capital rule, I believe NCUA is signalling its expectations to credit unions that a risk-based capital ratio of 10.5 percent, which is the minimum requirement for being well-capitalized, is not enough.

Metsger believes that prudent capital management should include a capital buffer above the minimum requirement for being well-capitalized.

Metsger wrote:

Maintaining a buffer, like a reserve fuel source, is certainly prudent management—but how much of a buffer is actually needed? As currently written and using the most recent data, the proposed rule identifies 20 credit unions that are undercapitalized and an additional 210 credit unions in the “buffer zone” as adequately capitalized. In total, these 230 credit unions represent just 7.6 percent of credit union assets subject to the proposed rule. Another 15.5 percent of credit unions are well-capitalized, but with less than 20 percent cushion above the 10.5 percent threshold as shown in the

graph to the right.

The remaining 1,595 credit unions with more than $50 million in assets—which collectively hold 77 percent of covered credit union [assets] already have at least a 20 percent risk-based capital buffer. In fact, a quarter of a trillion dollars in assets reside in credit unions whose buffer is a whopping 50 percent or more than the well-capitalized standard.

Reasonable people can debate what constitutes a prudential buffer. But a 20 percent cushion above a credit union’s “yellow warning light” is a pretty big buffer.

So while Metsger is trying to tell most credit unions covered by the proposed rule that they are holding more than enough capital and should not worry about the proposed risk-based capital rule, I believe NCUA is signalling its expectations to credit unions that a risk-based capital ratio of 10.5 percent, which is the minimum requirement for being well-capitalized, is not enough.

Wednesday, July 23, 2014

Matz: CU System Would Not Have Survived without $26 Billion in Federal Government Assistance

In a July 23 speech to the Annual Convention of the National Association of Federla Credit Unions, NCUA Chairman Debbie Matz defended the agency's risk-based capital proposal by pointing out the credit unions received significant assistance from the federal government and would not have survived without it.

Matz said:

Read Matz's speech.

Matz said:

"While the worst of the crisis now appears to be receding into the rearview mirror, we cannot forget its lessons. First and foremost, we cannot forget that the federal government had to pump $26 billion into the credit union system to prevent it from collapsing. Without an infusion of $20 billion from NCUA’s Central Liquidity Facility and an additional $6 billion from NCUA’s line of credit at the U.S. Treasury, the credit union system as we know it would probably not have survived.

Even with this extraordinary assistance from the federal government, 102 credit unions still failed. Many of those credit unions appeared to have sufficient capital. That is, until they collapsed. Those failures cost the Share Insurance Fund three-quarters of a billion dollars. Through strong supervision, we were able to prevent an additional $1.5 billion dollars in losses from troubled credit unions that were on the brink of failing."

Read Matz's speech.

CFPB Proposal Would Subject Banks and CUs to Reputational Risk

Several years ago, I spoke to the 33rd Annual National Directors' Convention in Las Vegas about the huge threat that the Consumer Financial Protection Bureau (CFPB) poses to banks and credit unions.

The latest example of this threat is a new proposal by the CFPB to publish consumers’ narratives in its consumer complaint database. A company subject to a complaint would be given an opportunity to post a response that would appear next to a customer’s story. If the company does not respond in 15 days, the complaint narrative would be published.

The CFPB states that "by giving consumers an option to publicly share their stories, the CFPB would greatly enhance the utility of the database, a platform designed to provide consumers with valuable information needed to make better financial choices for themselves and their families."

But unlike YELP, the CFPB database will not include information about favorable consumer experiences.

The public disclosure of unverified consumer complaint narratives will not advance the goal of helping consumers to make informed and responsible financial decisions. However, it will subject financial institutions to reputational risk.

Read the press release.

The latest example of this threat is a new proposal by the CFPB to publish consumers’ narratives in its consumer complaint database. A company subject to a complaint would be given an opportunity to post a response that would appear next to a customer’s story. If the company does not respond in 15 days, the complaint narrative would be published.

The CFPB states that "by giving consumers an option to publicly share their stories, the CFPB would greatly enhance the utility of the database, a platform designed to provide consumers with valuable information needed to make better financial choices for themselves and their families."

But unlike YELP, the CFPB database will not include information about favorable consumer experiences.

The public disclosure of unverified consumer complaint narratives will not advance the goal of helping consumers to make informed and responsible financial decisions. However, it will subject financial institutions to reputational risk.

Read the press release.

Tuesday, July 22, 2014

Monterey CU Seeking a Mutual Bank Charter

Credit Union Times is reporting that privately-insured Monterey Credit Union is in the process of switching to a mutual savings bank charter.

The credit union cited limitations in making business loans as a reason for the charter conversion.

The credit union has applied to the California Department of Business Oversight for a mutual savings bank charter and to the FDIC for federal deposit insurance.

Ballots and information on the charter conversion were mailed to members on May 31 with ballots due by July 25.

Read the story.

The credit union cited limitations in making business loans as a reason for the charter conversion.

The credit union has applied to the California Department of Business Oversight for a mutual savings bank charter and to the FDIC for federal deposit insurance.

Ballots and information on the charter conversion were mailed to members on May 31 with ballots due by July 25.

Read the story.

Chairman Matz's Reply to Rep. McHenry on Risk-Based Capital Proposal

Below is a six page letter from NCUA Chairman Debbie Matz to Representative McHenry, regarding the agency's proposed risk-based capital rule.

Monday, July 21, 2014

Bill Would Exempt Biz Loans to Veterans from MBL Cap

Representative Jeff Miller (R-Fla.) introduced a bill (H.R. 5061) that would exclude business loans to veterans from the definition of a member business loan (MBL). As a result, these loans would not count against a credit union's aggregate member business lending (MBL) cap of 12.25 percent of assets.

Credit union advocates have been quick to applaud the bill, because they are eager for any legislation that would facilitate credit union efforts to make more business loans and evade the aggregate MBL cap.

However, excluding business loans to veterans from the definition of MBL does not seem to fit the current list of exclusions to the MBL definition -- loans of $50,000 or less, loans guaranteed by governmental agencies, and loans secured by primary residence or deposits.

The current exclusions from the MBL definition pose minimal safety and soundness risk to credit unions and the National Credit Union Share Insurance Fund (NCUSIF) by limiting the size of the loss on a defaulted business loan.

The same cannot be said for H.R. 5061.

While the cause of this bill may be noble, H.R. 5061 potentially increases the risk of loss to the NCUSIF, as these veteran business loans are no longer subject to NCUA's MBL regulations.

Read the bill.

Credit union advocates have been quick to applaud the bill, because they are eager for any legislation that would facilitate credit union efforts to make more business loans and evade the aggregate MBL cap.

However, excluding business loans to veterans from the definition of MBL does not seem to fit the current list of exclusions to the MBL definition -- loans of $50,000 or less, loans guaranteed by governmental agencies, and loans secured by primary residence or deposits.

The current exclusions from the MBL definition pose minimal safety and soundness risk to credit unions and the National Credit Union Share Insurance Fund (NCUSIF) by limiting the size of the loss on a defaulted business loan.

The same cannot be said for H.R. 5061.

While the cause of this bill may be noble, H.R. 5061 potentially increases the risk of loss to the NCUSIF, as these veteran business loans are no longer subject to NCUA's MBL regulations.

Read the bill.

Thursday, July 17, 2014

Two California CUs Agree to Consent Orders

San Diego Metropolitan Credit Union (San Diego, CA) and Eagle Credit Union (Lodi, CA) have entered into consent agreements with the California Department of Business Oversight.

The consent order against San Diego Metropolitan Credit Union requires the credit union to retain management and a Board of Directors acceptable to the Commissioner. In addition, the order requires San Diego County Metropolitan Credit Union to develop, adopt and implement a plan to materially reduce the risk in its Troubled Debt Restructures (TDR) portfolio and to fully document and support that the member has the ability to repay on future TDRs. San Diego Metropolitan Credit Union is also expected to develop and implement a plan to reduce its interest rate risk within 60 days of the date of the Order, including lowering its exposure to mortgage related loans and investments to no more than 600 percent of net worth by the end of 2014 and 500 percent of net worth by the end of 2015.

Read San Diego Metropolitan Credit Union's consent order.

The consent order against Eagle Credit Union requires the credit union to retain management and a Board of Directors acceptable to the Commissioner. Eagle Credit Union will take corrective actions to address all accounting and internal control deficiencies identified in the examinations dated December 31, 2013 and June 30, 2013 and the CPA audit as of September 30, 2013. The credit union is also expected to develop a reconciliation matrix to assure adequate oversight and adherence to the general ledger account reconciliation policy and procedures. Furthermore, Eagle Credit Union will develop, adopt, and submit a revised strategic plan and budget, documenting specific actions to be taken, the assumptions made, and the timeframes necessary to achieve positive earnings and net worth trends by year-end 2014. This order replaces an earlier enforcement order from February 6, 2012.

Read Eagle Credit Union's consent order.

The consent order against San Diego Metropolitan Credit Union requires the credit union to retain management and a Board of Directors acceptable to the Commissioner. In addition, the order requires San Diego County Metropolitan Credit Union to develop, adopt and implement a plan to materially reduce the risk in its Troubled Debt Restructures (TDR) portfolio and to fully document and support that the member has the ability to repay on future TDRs. San Diego Metropolitan Credit Union is also expected to develop and implement a plan to reduce its interest rate risk within 60 days of the date of the Order, including lowering its exposure to mortgage related loans and investments to no more than 600 percent of net worth by the end of 2014 and 500 percent of net worth by the end of 2015.

Read San Diego Metropolitan Credit Union's consent order.

The consent order against Eagle Credit Union requires the credit union to retain management and a Board of Directors acceptable to the Commissioner. Eagle Credit Union will take corrective actions to address all accounting and internal control deficiencies identified in the examinations dated December 31, 2013 and June 30, 2013 and the CPA audit as of September 30, 2013. The credit union is also expected to develop a reconciliation matrix to assure adequate oversight and adherence to the general ledger account reconciliation policy and procedures. Furthermore, Eagle Credit Union will develop, adopt, and submit a revised strategic plan and budget, documenting specific actions to be taken, the assumptions made, and the timeframes necessary to achieve positive earnings and net worth trends by year-end 2014. This order replaces an earlier enforcement order from February 6, 2012.

Read Eagle Credit Union's consent order.

VAROOM VAROOM: CU Is Title Sponsor for NASCAR Late Model Race

Martinsville DuPont Credit Union will be the title sponsor of the NASCAR Late Model MDCU 300 on October 5.

While the terms of the deal were not disclosed, the agreement between the Martinsville Speedway and the credit union is for multiple years.

Some credit union advocates will justify this sponsorship as a legitimate marketing expense.

But taxpayers and policymakers need to ask if this is the appropriate use of the credit union's tax exemption.

Read the story.

While the terms of the deal were not disclosed, the agreement between the Martinsville Speedway and the credit union is for multiple years.

Some credit union advocates will justify this sponsorship as a legitimate marketing expense.

But taxpayers and policymakers need to ask if this is the appropriate use of the credit union's tax exemption.

Read the story.

Wednesday, July 16, 2014

Overstated Benefits of CU Membership

The credit union industry has overstated the aggregate benefits arising from credit union membership.

Credit Union National Association's calculations are based upon dubious assumptions.

CUNA compares the average credit union savings account yields, loan interest rates, and fees to average bank savings account yields, loan interest rates, and fees. However, people don't make financial decisions based upon averages. In many cases, the best rates are offered by banks and other financial service providers. Pursuing average savings yields, loan rates, and fees would cause consumers to be net losers.

Let's investigate two calculations by CUNA regarding credit cards. CUNA's analysis assumes all credit union members are revolving their credit card balances. However, approximately 60 percent of all credit cardholders are “convenience users” and thereby avoid interest charges by paying off their balances in full each month. This would indicate that CUNA has clearly overstated the interest savings from credit cards to credit union members.

Also, CUNA's benefit estimation points out how much people would save if they were late making their credit card payments; because on average credit unions charge a lower late fee than banks. However, this benefit only arises to people who don't pay their credit cards on time. But if you make your payment on time, you aren't subject to this fee and there is no benefit.

Let's now look at insufficient fund (NSF) fees. CUNA states that credit unions on average charge a lower fee and this provides a monetary benefit to credit union members. However, 85 percent of all consumers did not overdraw their accounts in 2013, according to Ipsos Survey. So, unless you are serially overdrawing your account, there is not any benefit from this fee differential.

So as best I can tell, CUNA's benefit estimation is based upon fuzzy math and dubious assumptions.

Credit Union National Association's calculations are based upon dubious assumptions.

CUNA compares the average credit union savings account yields, loan interest rates, and fees to average bank savings account yields, loan interest rates, and fees. However, people don't make financial decisions based upon averages. In many cases, the best rates are offered by banks and other financial service providers. Pursuing average savings yields, loan rates, and fees would cause consumers to be net losers.

Let's investigate two calculations by CUNA regarding credit cards. CUNA's analysis assumes all credit union members are revolving their credit card balances. However, approximately 60 percent of all credit cardholders are “convenience users” and thereby avoid interest charges by paying off their balances in full each month. This would indicate that CUNA has clearly overstated the interest savings from credit cards to credit union members.

Also, CUNA's benefit estimation points out how much people would save if they were late making their credit card payments; because on average credit unions charge a lower late fee than banks. However, this benefit only arises to people who don't pay their credit cards on time. But if you make your payment on time, you aren't subject to this fee and there is no benefit.

Let's now look at insufficient fund (NSF) fees. CUNA states that credit unions on average charge a lower fee and this provides a monetary benefit to credit union members. However, 85 percent of all consumers did not overdraw their accounts in 2013, according to Ipsos Survey. So, unless you are serially overdrawing your account, there is not any benefit from this fee differential.

So as best I can tell, CUNA's benefit estimation is based upon fuzzy math and dubious assumptions.

Monday, July 14, 2014

Credit Union Sweep Programs

At the end of the first quarter of 2013, 153 credit unions had sweep account programs, where funds were transferred from share drafts (transactional accounts) to regular shares or money market accounts (nontransactional).

By sweeping these checking deposits into a nontransaction account, a credit union is reducing its required reserves.

In general, it is large credit unions that have sweep account programs. The median asset size for a credit union with a sweep account program was $901 million, while the mean asset size was $2.5 billion.

Hudson Valley Federal Credit Union (Poughkeepsie, NY) had almost $1.7 billion in share drafts being swept into regular shares or money market accounts, as of March 31, 2014. The following table ranks the top 25 credit unions sweep account programs on the dollar amount of accounts swept.

As of March 31, 2014, approximately 14 percent of all deposits at these 153 credit unions were in a sweep account program. However, some credit unions reported having a large percentage of their share drafts being swept into regular shares or money market accounts. Cascade Community CU in Roseburg (OR) reported that almost 72.5 percent of its checking accounts were swept into nontransactional accounts. The following table provides a list of the credit unions with the highest incidence of swept shares as a percent of total deposits.

By sweeping these checking deposits into a nontransaction account, a credit union is reducing its required reserves.

In general, it is large credit unions that have sweep account programs. The median asset size for a credit union with a sweep account program was $901 million, while the mean asset size was $2.5 billion.

Hudson Valley Federal Credit Union (Poughkeepsie, NY) had almost $1.7 billion in share drafts being swept into regular shares or money market accounts, as of March 31, 2014. The following table ranks the top 25 credit unions sweep account programs on the dollar amount of accounts swept.

As of March 31, 2014, approximately 14 percent of all deposits at these 153 credit unions were in a sweep account program. However, some credit unions reported having a large percentage of their share drafts being swept into regular shares or money market accounts. Cascade Community CU in Roseburg (OR) reported that almost 72.5 percent of its checking accounts were swept into nontransactional accounts. The following table provides a list of the credit unions with the highest incidence of swept shares as a percent of total deposits.

Friday, July 11, 2014

IBEW Local 816 FCU Closed

The National Credit Union Administration liquidated IBEW Local 816 Federal Credit Union of Paducah, Kentucky.

NCUA made the decision to liquidate IBEW Local 816 Federal Credit Union and discontinue its operations after determining the credit union was insolvent and had no prospect for restoring viable operations.

IBEW Local 816 Federal Credit Union served 929 members and had assets of approximately $6.3 million, according to the credit union’s most recent Call Report. Chartered in 1954, IBEW Local 816 Federal Credit Union served members, employees and their families of the International Brotherhood of Electrical Workers, AFL-CIO, in Paducah.

Read the press release.

NCUA made the decision to liquidate IBEW Local 816 Federal Credit Union and discontinue its operations after determining the credit union was insolvent and had no prospect for restoring viable operations.

IBEW Local 816 Federal Credit Union served 929 members and had assets of approximately $6.3 million, according to the credit union’s most recent Call Report. Chartered in 1954, IBEW Local 816 Federal Credit Union served members, employees and their families of the International Brotherhood of Electrical Workers, AFL-CIO, in Paducah.

Read the press release.

TDECU Paying $15 Million over 10-Years for Naming Rights to Football Stadium

Texas Dow Employees Credit Union (TDECU), the largest credit union in the Houston area with more than $2 billion in assets, will pay $15 million over 10-years for the naming rights to the new University of Houston Football Stadium.

The new stadium will be called TDECU Stadium.

The deal includes a TDECU suite on the 50-yard line and discount tickets for TDECU employees and members.

Read the story.

The new stadium will be called TDECU Stadium.

The deal includes a TDECU suite on the 50-yard line and discount tickets for TDECU employees and members.

Read the story.

Thursday, July 10, 2014

Should the Wealthy Get Taxpayer Subsidized Financial Services?

Gina Ragusa, writing a column on Credit Union Online, asked the following question: "Should the Wealthy Be Denied Credit Union Membership?"

The more relevant policy question is should the wealthy get taxpayer subsidized financial services?

Credit unions are tax exempt because they are meant to meet the financial needs of consumers, especially individuals of modest means. This is the public policy rationale for the credit union tax exemption and was reaffirmed by Congress in 1998.

Unfortunately, this tax exemption is poorly targeted. Both people of means and of modest means are recipients of this taxpayer subsidy with the largest portion of the tax exemption accruing to wealthier credit union members.

This would indicate that credit unions are a poor delivery vehicle of this taxpayer subsidy, thus undermining the policy rationale for the tax exemption.

Policymakers would get more bang for the buck by repealing the credit union tax exemption and directly targeting the tax subsidy at people of modest means.

If the tax exemption was repealed, there would not be any reason to debate whether the wealthy should be credit union members. No one would care.

The more relevant policy question is should the wealthy get taxpayer subsidized financial services?

Credit unions are tax exempt because they are meant to meet the financial needs of consumers, especially individuals of modest means. This is the public policy rationale for the credit union tax exemption and was reaffirmed by Congress in 1998.

Unfortunately, this tax exemption is poorly targeted. Both people of means and of modest means are recipients of this taxpayer subsidy with the largest portion of the tax exemption accruing to wealthier credit union members.

This would indicate that credit unions are a poor delivery vehicle of this taxpayer subsidy, thus undermining the policy rationale for the tax exemption.

Policymakers would get more bang for the buck by repealing the credit union tax exemption and directly targeting the tax subsidy at people of modest means.

If the tax exemption was repealed, there would not be any reason to debate whether the wealthy should be credit union members. No one would care.

Wednesday, July 9, 2014

Cornerstone Community FCU Buys Naming Rights to Ice Arena, Terms Not Disclosed

Cornerstone Community Federal Credit Union (Lockport, NY) has signed a 12-year naming rights deal with Lockport Ice Arena & Sports Center Inc.

The new 93,500 square foot arena will be called Cornerstone CFCU Arena. The agreement includes "exclusive exterior facility naming rights, interior and exterior signage, on-site ATM presence and use of the facility on select Cornerstone member nights."

The terms of the deal were not disclosed.

However, shouldn't credit unions be required to disclose the terms of the deal?

After all, credit unions are receiveing a valuable benefit from the American taxpayers in the form of their preferential tax treatment.

Read the story.

The new 93,500 square foot arena will be called Cornerstone CFCU Arena. The agreement includes "exclusive exterior facility naming rights, interior and exterior signage, on-site ATM presence and use of the facility on select Cornerstone member nights."

The terms of the deal were not disclosed.

However, shouldn't credit unions be required to disclose the terms of the deal?

After all, credit unions are receiveing a valuable benefit from the American taxpayers in the form of their preferential tax treatment.

Read the story.

Tuesday, July 8, 2014

No Corporate Separateness between CUs and Association

Eli Lilly FCU (Indianapolis, IN) and Inova FCU (Elkhart, IN) are using an association, Tru Direction, to evade field of membership limitations.

While Inova includes Tru Direction in its list of organizations that allow you to join the credit union, Eli Lilly FCU is blatantly advertising that this association can be used to qualify people for credit union membership, who otherwise are not able to join the credit union.

On Eli Lilly FCU's website, the credit union writes:

"If you are not affiliated with any of the above organizations, you can STILL become a member by joining Tru Direction, a non-profit association dedicated to financial literacy."

You can join Tru Direction by making a one-time payment of $5.

But there does not appear to be any corporate separateness between Tru Direction and these two credit unions.

The Board of Directors of Tru Direction is totally comprised of employees from the two credit unions.

A further indication that there is a lack of corporate separateness between the credit unions and the association is that the only membership benefit listed on Tru Direction's website is being eligible to join any of our affiliate credit unions.

While Inova includes Tru Direction in its list of organizations that allow you to join the credit union, Eli Lilly FCU is blatantly advertising that this association can be used to qualify people for credit union membership, who otherwise are not able to join the credit union.

On Eli Lilly FCU's website, the credit union writes:

"If you are not affiliated with any of the above organizations, you can STILL become a member by joining Tru Direction, a non-profit association dedicated to financial literacy."

You can join Tru Direction by making a one-time payment of $5.

But there does not appear to be any corporate separateness between Tru Direction and these two credit unions.

The Board of Directors of Tru Direction is totally comprised of employees from the two credit unions.

- Matt Snively, Board Chair, is a SVP, Wealth Mgmt & Strategic Projects at Eli Liily FCU;

- Vicki Spicher, Vice Chair, is VP of Operations at Inova FCU;

- Lisa Markland, Treasurer, works in Human Resources at Eli Lilly FCU; and

- Claire Kellems, Secretary, is an Executive Assistant at Inova FCU.

A further indication that there is a lack of corporate separateness between the credit unions and the association is that the only membership benefit listed on Tru Direction's website is being eligible to join any of our affiliate credit unions.

Thursday, July 3, 2014

NCUA: Credit Union Regulator or Cheerleader?

Once again, the National Credit Union Administration (NCUA) has confused its role as a credit union regulator for being the head cheerleader from the credit union industry.

On July 2 NCUA Board member Michael Fryzel wrote an opinion piece responding to opinion expressed by Frank Keating, the president and CEO of the American Bankers Association, about NCUA chartering a credit union to serve pro athletes.

However NCUA Board member Fryzel never addresses the issue about a credit union for pro athletes. Maybe that would be too hard to explain.

Instead he writes about how wonderful credit unions are and how people of means and of modest means prefer credit unions.

Tell that to the poor guy in Florida who got the run around from Achieva CU and Fryzel's agency. See my June 21 blog post.

He then launches into the credit union lobby's litany that credit unions offer better rates, better service, lower fees, and greater convenience. Yada, Yada, Yada.

This opinion piece is what I would expect from credit union trade associations, but is inappropriate from a regulator.

Read the Fryzel opinion piece.

On July 2 NCUA Board member Michael Fryzel wrote an opinion piece responding to opinion expressed by Frank Keating, the president and CEO of the American Bankers Association, about NCUA chartering a credit union to serve pro athletes.

However NCUA Board member Fryzel never addresses the issue about a credit union for pro athletes. Maybe that would be too hard to explain.

Instead he writes about how wonderful credit unions are and how people of means and of modest means prefer credit unions.

Tell that to the poor guy in Florida who got the run around from Achieva CU and Fryzel's agency. See my June 21 blog post.

He then launches into the credit union lobby's litany that credit unions offer better rates, better service, lower fees, and greater convenience. Yada, Yada, Yada.

This opinion piece is what I would expect from credit union trade associations, but is inappropriate from a regulator.

Read the Fryzel opinion piece.

Wednesday, July 2, 2014

45 Percent of CUs Reported Higher Earnings Than A Year Ago

For the first quarter of 2014, 2997 credit unions reported higher net income than for the same time period in 2013.

Slightly fewer credit unions, 2,965, reported improved profitability year-over-year, when measured by return on average assets (ROA).

The following table shows the number of credit unions by asset size reporting higher earnings or ROA for the first quarter of 2014 compared to the same time period last year.

Slightly fewer credit unions, 2,965, reported improved profitability year-over-year, when measured by return on average assets (ROA).

The following table shows the number of credit unions by asset size reporting higher earnings or ROA for the first quarter of 2014 compared to the same time period last year.

Tuesday, July 1, 2014

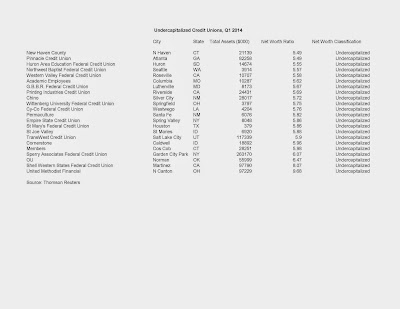

Undercapitalized CUs, Q1 2014

Sixty-three credit unions were undercapitalized at the end of the first quarter of 2014. This was an increase of two credit unions from the end of 2013; but down 31 credit unions from a year ago.

The 63 undercapitalized credit unions reported slightly more than $3.5 billion in assets at the end of the first quarter of 2014.

Four credit unions were critically undercapitalized. Another 13 credit unions were significantly undercapitalized.

Although four credit unions had net worth leverage ratios in excess of 6 percent, their risk-based net worth ratios indicated that they were undercapitalized.

The 63 undercapitalized credit unions reported slightly more than $3.5 billion in assets at the end of the first quarter of 2014.

Four credit unions were critically undercapitalized. Another 13 credit unions were significantly undercapitalized.

Although four credit unions had net worth leverage ratios in excess of 6 percent, their risk-based net worth ratios indicated that they were undercapitalized.