Good Shepherd Credit Union (Chicago, IL) was involuntarily liquidated by the Illinois Department of Financial and Professional Regulation.

The credit union had its operations suspended earlier this year by the state credit union regulator.

Good Shepherd was privately insured by American Share Insurance.

Read the Involuntary Liquidation Order.

Wednesday, June 29, 2016

Tuesday, June 28, 2016

Equal Pay and EEOC Proposal to Collect Pay Data

In case you missed it, earlier this year the Equal Employment Opportunity Commission (EEOC) announced proposed revisions to the EEO-1 report to collect pay information.

The EEOC justifies this rule because it believes pay discrimination remains a persistent problem.

While the proposal has not been finalized, it would require employers with 100 or more employees to add pay data and hours worked by sex, race and ethnicity in each of the EEO-1 job categories.

As of March 2016, 633 credit unions reported having at least 100 full-time and part-time employees.

Currently, covered employers provide information regarding the racial, ethnic, and sex makeup of their workforces on the EEO-1 report, including information regarding job categories.

Under the proposal, for each of the EEO-1 job categories, the proposed EEO-1 would add 12 pay bands. For each job category, employers would tabulate and report the number of employees whose W-2 earnings for the prior 12 months fell within each pay band by their ethnicity, race and sex as well as their hours worked.

The EEOC selected total W-2 earnings as the measure of pay because it believes this measure will maximize the usefulness of the EEO-1 pay data while minimizing the burden on employers to collect and report it. According to the agency, its goal was to identify a measure of compensation that encompasses as much employer-paid income earned by individuals as possible.

The agency believes that this information will assist employers in evaluating their pay practices to prevent pay discrimination

Also, this pay data will be used to assess complaints of discrimination, focus agency investigations, and identify existing pay disparities that may warrant further examination.

However, Robin Shea of the law firm of Constangy, Brooks, Smith & Prophete raised 5 reasons why she is opposed to the this proposal, including it is based on dubious science, it will result in a lot of baseless charges against employers, and it will involve an excessive amount of busy work.

Read the EEOC press release.

The EEOC justifies this rule because it believes pay discrimination remains a persistent problem.

While the proposal has not been finalized, it would require employers with 100 or more employees to add pay data and hours worked by sex, race and ethnicity in each of the EEO-1 job categories.

As of March 2016, 633 credit unions reported having at least 100 full-time and part-time employees.

Currently, covered employers provide information regarding the racial, ethnic, and sex makeup of their workforces on the EEO-1 report, including information regarding job categories.

Under the proposal, for each of the EEO-1 job categories, the proposed EEO-1 would add 12 pay bands. For each job category, employers would tabulate and report the number of employees whose W-2 earnings for the prior 12 months fell within each pay band by their ethnicity, race and sex as well as their hours worked.

The EEOC selected total W-2 earnings as the measure of pay because it believes this measure will maximize the usefulness of the EEO-1 pay data while minimizing the burden on employers to collect and report it. According to the agency, its goal was to identify a measure of compensation that encompasses as much employer-paid income earned by individuals as possible.

The agency believes that this information will assist employers in evaluating their pay practices to prevent pay discrimination

Also, this pay data will be used to assess complaints of discrimination, focus agency investigations, and identify existing pay disparities that may warrant further examination.

However, Robin Shea of the law firm of Constangy, Brooks, Smith & Prophete raised 5 reasons why she is opposed to the this proposal, including it is based on dubious science, it will result in a lot of baseless charges against employers, and it will involve an excessive amount of busy work.

Read the EEOC press release.

Friday, June 24, 2016

Legacy Community FCU Buys Naming Rights to UAB Practice Field

Legacy Community Federal Credit Union (Birmingham, AL) purchased the naming rights to the covered practice field at the University of Alabama Birmingham (UAB).

The deal is for $4.2 million and 20 years.

As a result of the sponsorship, Legacy Community has become the official credit union of UAB, and Blazer Football will conduct practice activities at Legacy Pavilion.

The sponsorship allowed UAB to expand its plans for a new football complex.

Read the story.

Read the press release.

The deal is for $4.2 million and 20 years.

As a result of the sponsorship, Legacy Community has become the official credit union of UAB, and Blazer Football will conduct practice activities at Legacy Pavilion.

The sponsorship allowed UAB to expand its plans for a new football complex.

Read the story.

Read the press release.

CEO Worries that Some CUs Seeking Low-Income Designation for Wrong Reason

According to Credit Union Times, Todd Lane, CEO of California Coast Credit Union (San Diego, CA), is worried that some larger credit unions are seeking a low-income designation for the wrong reason.

Instead of serving low-income members, Lane believes that the real motivation of these credit unions to pursue a low-income designation is to circumvent the member business loan cap of 12.25 percent of assets. Low-income designated credit unions are exempt from the member business loan cap.

Speaking on a panel at the Southern California Credit Union Alliance 2016 Conference, Lane stated:

Lane noted that this behavior is chipping "away at a credit union being a credit union" and believes that the credit union industry is at the tipping point with regard to taxation.

Read Lane's comments.

Instead of serving low-income members, Lane believes that the real motivation of these credit unions to pursue a low-income designation is to circumvent the member business loan cap of 12.25 percent of assets. Low-income designated credit unions are exempt from the member business loan cap.

Speaking on a panel at the Southern California Credit Union Alliance 2016 Conference, Lane stated:

"Another thing that bothers me is the low-income designation. I’ve seen larger credit unions seek and get low-income designation and I wonder what their real purpose is behind it. I think in some cases, I don't want to paint everyone with a broad brush here, but I've heard – people talk about these things – we hear they're doing it to get around regulation. In particular, the member business lending cap."

Lane noted that this behavior is chipping "away at a credit union being a credit union" and believes that the credit union industry is at the tipping point with regard to taxation.

Read Lane's comments.

Wednesday, June 22, 2016

Bill Would Allow All CUs to Serve Underserved Areas

Reps. Tim Ryan (D-OH) and Donald Norcross (D-NJ) on Tuesday introduced a bill, H.R. 5541 -- the Financial Services for the Underserved Act, that would allow credit unions of all charter types to add underserved areas to their fields of membership.

Rep. Ann Kirkpatrick (R-AZ) has signed on as a cosponsor of the bill.

Currently, only credit unions with multiple-group charters can add underserved areas to their fields of membership.

Rep. Ann Kirkpatrick (R-AZ) has signed on as a cosponsor of the bill.

Currently, only credit unions with multiple-group charters can add underserved areas to their fields of membership.

Monday, June 20, 2016

Two Privately Insured CUs Approved for FHLB Membership

Two privately insured credit unions have been approved for Federal Home Loan Bank (FHLB) membership, according to American Share Insurance (ASI).

FHLB of Indianapolis approved $1.2 billion Beacon Credit Union (Wabash, IN) for membership and FHLB of Chicago approved $785 million Credit Union 1 (Rantoul, IL) for membership.

The FAST Act (H.R. 22), which was enacted in December 2015, authorized that a privately insured credit union could join a FHLB.

ASI has been meeting with seven FHLBs to educate them about private share insurance, privately insured credit unions and American Share’s role in the oversight of privately insured credit unions.

For more information, click here.

FHLB of Indianapolis approved $1.2 billion Beacon Credit Union (Wabash, IN) for membership and FHLB of Chicago approved $785 million Credit Union 1 (Rantoul, IL) for membership.

The FAST Act (H.R. 22), which was enacted in December 2015, authorized that a privately insured credit union could join a FHLB.

ASI has been meeting with seven FHLBs to educate them about private share insurance, privately insured credit unions and American Share’s role in the oversight of privately insured credit unions.

For more information, click here.

Friday, June 17, 2016

Texans CU Emerges from Conservatorship

The National Credit Union Administration (NCUA) returned control of Texans Credit Union (Richardson, TX) to its members.

NCUA placed Texans into conservatorship in April 2011.

NCUA stated that the conservatorship was successful due to the efforts to carefully and deliberately mitigate exposure and risk from troubled assets, improve lending controls, revitalize operations, and improve operating efficiencies.

Texans is the first federally insured credit union to emerge from NCUA conservatorship in 2016.

Read the press release.

NCUA placed Texans into conservatorship in April 2011.

NCUA stated that the conservatorship was successful due to the efforts to carefully and deliberately mitigate exposure and risk from troubled assets, improve lending controls, revitalize operations, and improve operating efficiencies.

Texans is the first federally insured credit union to emerge from NCUA conservatorship in 2016.

Read the press release.

Thursday, June 16, 2016

Bill Would Repeal Durbin Amendment

Rep. Randy Neugebauer (R-Texas) introduced legislation, H.R. 5465, to repeal Section 1075 of the Dodd-Frank Act, better known as the Durbin Amendment.

The Durbin Amendment imposed a cap on debit interchange fees charged by banks and credit unions with $10 billion or more in assets.

In introducing the bill, Rep. Neugebauer stated:

Rep. Neugebauer concluded: "This legislation will restore competition in the marketplace, remove arbitrary government price caps, and ensure consumers have affordable access to basic banking services."

This is legislation that both banks and credit unions can support.

Read the press release.

The Durbin Amendment imposed a cap on debit interchange fees charged by banks and credit unions with $10 billion or more in assets.

In introducing the bill, Rep. Neugebauer stated:

"Sen. Dick Durbin (D-Ill.) and the retail lobby sold Congress on the need for debit swipe fee reform under the guise that consumers would see significant savings if the government controlled the price of these transactions. Instead, several studies, including research from the Federal Reserve Bank of Richmond, have definitely shown that consumers have not received any passed-through savings. Some studies have even shown that these price caps have resulted in reduced free checking accounts and higher minimum balances for consumers. Further, some small businesses and those with a high volume of small-dollar transactions are actually fairing worse with the price caps in place – a strange twist for the retail industry, which was lobbying so hard for the Durbin Amendment’s adoption."

Rep. Neugebauer concluded: "This legislation will restore competition in the marketplace, remove arbitrary government price caps, and ensure consumers have affordable access to basic banking services."

This is legislation that both banks and credit unions can support.

Read the press release.

Wednesday, June 15, 2016

Kellogg Community Switches to State Charter

Kellogg Community Federal Credit Union (Battle Creek, MI) switched from a federal to state charter, effective June 1.

By becoming a state chartered credit union, Kellogg Community can expand its field of membership to include 15 Southwestern Michigan counties.

This abandonment of the federal charter will cause the National Credit Union Administration (NCUA) to further push the envelope on field of membership issues, as NCUA competes with the states on membership requirements.

Read the press release.

By becoming a state chartered credit union, Kellogg Community can expand its field of membership to include 15 Southwestern Michigan counties.

This abandonment of the federal charter will cause the National Credit Union Administration (NCUA) to further push the envelope on field of membership issues, as NCUA competes with the states on membership requirements.

Read the press release.

Tuesday, June 14, 2016

NCUA Tells Chairman Hensarling to Keep Exam Cycle Flexibility

In a June 8th letter to House Financial Services Committee Chairman Jeb Hensarling (R -TX), National Credit Union Administration (NCUA) Chairman Rick Metsger wrote that "[n]ow that the economy and the credit union system have stabilized, I believe that the NCUA board should act thoughtfully and promptly to modify the exam cycle."

In the letter, the agency stated that it would prefer to adjust the examination cycle by regulation.

However, Metsger was opposed to statutory changes that hard code the exam cycle into law. Metsger believes such legislation could limit the agency's flexibility to respond to the next financial crisis and increase losses to the National Credit Union Share Insurance Fund.

On a related note, on June 9th, Rep. Guinta (R - NH) introduced a bill (H.R. 5419) to amend the Federal Credit Union Act to extend the examination cycle of the NCUA to 18 months for certain credit unions

In the letter, the agency stated that it would prefer to adjust the examination cycle by regulation.

However, Metsger was opposed to statutory changes that hard code the exam cycle into law. Metsger believes such legislation could limit the agency's flexibility to respond to the next financial crisis and increase losses to the National Credit Union Share Insurance Fund.

On a related note, on June 9th, Rep. Guinta (R - NH) introduced a bill (H.R. 5419) to amend the Federal Credit Union Act to extend the examination cycle of the NCUA to 18 months for certain credit unions

Monday, June 13, 2016

50 Percent of CUs Had Fewer Members as of Q1 2016 Compared to A Year Ago

While overall credit union membership continued to grow during the year ending in the first quarter of 2016, at the median, membership was unchanged, according to the National Credit Union Administration.

Zero median membership growth means that, overall, 50 percent of federally insured credit unions had fewer members at the end of the first quarter of 2016 than a year earlier.

Over the previous year, the median membership growth rate was negative 0.4 percent, and 53 percent of credit unions lost members over the year ending in first quarter of 2015.

Membership growth over the most recent four quarters continued to be concentrated in larger credit unions. Credit unions with falling membership tended to be small; about 75 percent of those credit unions had assets of less than $50 million.

Alaska (4.0 percent) had the highest median membership growth rate over the year ending in the first quarter of 2016, followed by New Mexico (2.0 percent). Median membership growth was negative in 16 states. At the median, membership declined the most in Pennsylvania (-1.8 percent).

Read the press release.

Zero median membership growth means that, overall, 50 percent of federally insured credit unions had fewer members at the end of the first quarter of 2016 than a year earlier.

Over the previous year, the median membership growth rate was negative 0.4 percent, and 53 percent of credit unions lost members over the year ending in first quarter of 2015.

Membership growth over the most recent four quarters continued to be concentrated in larger credit unions. Credit unions with falling membership tended to be small; about 75 percent of those credit unions had assets of less than $50 million.

Alaska (4.0 percent) had the highest median membership growth rate over the year ending in the first quarter of 2016, followed by New Mexico (2.0 percent). Median membership growth was negative in 16 states. At the median, membership declined the most in Pennsylvania (-1.8 percent).

Read the press release.

Friday, June 10, 2016

Wisconsin CU Regulator to Add S to CAMEL

Effective July 1, Wisconsin's Office of Credit Unions (OCU) will add "Sensitivity to Market Risk" (S) component to CAMEL.

OCU wrote in a May 24 letter that it believes that the implementation of a "S" rating is prudent at this time.

OCU noted that changes in interest rates can impact the earnings and net worth of credit unions. OCU stated that credit unions are expected to have the ability to measure, monitor, and manage interest rate risk exposure.

OCU also pointed out that "[t]he utilization of S component recognizes the increasing balance sheet complexity in Wisconsin credit unions."

OCU noted that the National Credit Union Administration (NCUA) does not use the S CAMEL rating component. However, OCU and NCUA have agreed to a workaround. The lower of the "L" and "S" ratings will be inputted into NCUA's Automated Integrated Regulatory Examination Software for the L component in CAMEL.

On a related note, the NCUA Board on June 16th will receive a briefing on adding S to CAMEL.

Read the letter.

OCU wrote in a May 24 letter that it believes that the implementation of a "S" rating is prudent at this time.

OCU noted that changes in interest rates can impact the earnings and net worth of credit unions. OCU stated that credit unions are expected to have the ability to measure, monitor, and manage interest rate risk exposure.

OCU also pointed out that "[t]he utilization of S component recognizes the increasing balance sheet complexity in Wisconsin credit unions."

OCU noted that the National Credit Union Administration (NCUA) does not use the S CAMEL rating component. However, OCU and NCUA have agreed to a workaround. The lower of the "L" and "S" ratings will be inputted into NCUA's Automated Integrated Regulatory Examination Software for the L component in CAMEL.

On a related note, the NCUA Board on June 16th will receive a briefing on adding S to CAMEL.

Read the letter.

Thursday, June 9, 2016

UW Credit Union to Raise Its Minimum Wage to $15 Per Hour

The Milwaukee Journal Sentinel is reporting that University of Wisconsin (UW) Credit Union (Madison, WI) will raise its minimum wage to $15 per hour by September 2017.

UW Credit Union announced that it will boost its minimum wage from the current $12.60 to $13.80 this September, then hit $15 an hour a year later.

The higher minimum wage is expected to affect about 25 percent of UW Credit Union's 505 employees.

The increase in the minimum wage is expected to increase the credit union's operating budget by 0.6 percent.

Read the story.

UW Credit Union announced that it will boost its minimum wage from the current $12.60 to $13.80 this September, then hit $15 an hour a year later.

The higher minimum wage is expected to affect about 25 percent of UW Credit Union's 505 employees.

The increase in the minimum wage is expected to increase the credit union's operating budget by 0.6 percent.

Read the story.

Wednesday, June 8, 2016

Cost Per NCUA Employee at 2016 Training Event Up Over 21 Percent from 2014 Event

While the National Credit Union Administration (NCUA) was busy patting itself on the back for “Making a Difference” training program coming in below budget and below the cost of the 2014 National Training Conference, a careful review of the numbers shows that cost per employee attending the event went up.

The “Making a Difference” training program, held between April 4 and April 15 in Denver, came in $404,121 below its Board-approved budget. This was a savings of 18 percent. In addition, the amount spent on the 2016 training event was 6.7 percent below the expenditures for the 2014 event.

However, fewer employees attended the 2016 training conference than 2014. NCUA reported 1,242 employees attended the 2014 conference. In comparison, 954 employees attended the 2016 event. Attendance was down almost 23 percent between the 2014 and 2016 events.

This means the actual cost per employee was $1,539 for the 2014 event versus $1,869 for the 2016 event. In other words, cost per employee went up over 21 percent between the 2014 and 2016 event.

If the cost per employee came in at the 2014 level, the cost of the 2016 event would have been $1,468,206 instead of the actual cost of $1,782,999.

Read the press release.

The “Making a Difference” training program, held between April 4 and April 15 in Denver, came in $404,121 below its Board-approved budget. This was a savings of 18 percent. In addition, the amount spent on the 2016 training event was 6.7 percent below the expenditures for the 2014 event.

However, fewer employees attended the 2016 training conference than 2014. NCUA reported 1,242 employees attended the 2014 conference. In comparison, 954 employees attended the 2016 event. Attendance was down almost 23 percent between the 2014 and 2016 events.

This means the actual cost per employee was $1,539 for the 2014 event versus $1,869 for the 2016 event. In other words, cost per employee went up over 21 percent between the 2014 and 2016 event.

If the cost per employee came in at the 2014 level, the cost of the 2016 event would have been $1,468,206 instead of the actual cost of $1,782,999.

Read the press release.

Tuesday, June 7, 2016

Consumer Credit at CUs Grew at Annual Rate of $59.2 Billion for April

Outstanding consumer credit at credit unions for the month of April rose by almost $5 billion to $355.6 billion, according to the Federal Reserve.

Outstanding revolving credit at credit unions was nearly flat for April at $48.5 billion.

On the other hand, outstanding nonrevolving credit at credit unions for April increased by approximately $4.8 billion to $307 billion.

Read the G. 19 report.

Outstanding revolving credit at credit unions was nearly flat for April at $48.5 billion.

On the other hand, outstanding nonrevolving credit at credit unions for April increased by approximately $4.8 billion to $307 billion.

Read the G. 19 report.

Wrongful Dismissal Lawsuit Alleges Improper Accounting Practices to Boost CU CEO's Pay

A former chief financial officer of Rock Hill, Connecticut-based Nutmeg State Financial Credit Union (NSFCU), as well as his top lieutenant, have filed a civil lawsuit against the credit union claiming they were fired in retaliation for communicating with regulators about what they believed were improper accounting practices at the credit union, according to the Hartford Business Journal.

The complaint alleges the credit union artificially inflated profits through earnings management to boost the pay of the credit union's CEO, John Holt.

According to the complaint, "[b]y pushing out the losses, … Holt was able to keep … NSFCU's profits artificially inflated, which allowed his bonus and SERP [supplemental executive retirement plan] to be funded, even in months when … NSFCU's profit targets would have fallen short, and also at the expense of proper reporting practices and against the interests of … NSFCU's members and the public in general."

The plaintiffs claim that earnings management included underfunding the credit union's allowance for loan and lease losses account and stretching out the cost of closing the credit union's East Windsor branch.

The plaintiffs allege that those alleged practices violated state and federal law and were inconsistent with Generally Accepted Accounting Principles.

The plaintiffs are asking for back pay, lost benefits, punitive and other damages, and legal costs and fees.

Read the story.

The complaint alleges the credit union artificially inflated profits through earnings management to boost the pay of the credit union's CEO, John Holt.

According to the complaint, "[b]y pushing out the losses, … Holt was able to keep … NSFCU's profits artificially inflated, which allowed his bonus and SERP [supplemental executive retirement plan] to be funded, even in months when … NSFCU's profit targets would have fallen short, and also at the expense of proper reporting practices and against the interests of … NSFCU's members and the public in general."

The plaintiffs claim that earnings management included underfunding the credit union's allowance for loan and lease losses account and stretching out the cost of closing the credit union's East Windsor branch.

The plaintiffs allege that those alleged practices violated state and federal law and were inconsistent with Generally Accepted Accounting Principles.

The plaintiffs are asking for back pay, lost benefits, punitive and other damages, and legal costs and fees.

Read the story.

Monday, June 6, 2016

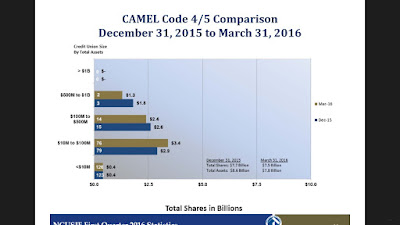

Are NCUSIF Reserves Underestimated?

At the end of the first quarter of 2016, the National Credit Union Administration (NCUA) reported that the National Credit Union Share Insurance Fund (NCUSIF) had reserves of $152.2 million as of March 31, 2016 -- $9.9 million is for specific natural person credit unions and $142.3 million is for general reserves. This is down by $10.7 million from $162.9 million, as of February 29, 2016.

According to the NCUA, the NCUSIF contingent liability is derived by using an internal econometric model that applies estimated failure and loss rates and takes into account the historical loss history, CAMEL ratings, credit union level financial ratios, and other conditions. In addition, specific analysis is performed on those insured credit unions where failure is imminent or where additional information is available that may affect the estimate of losses.

However, I believe NCUA may be underestimating the reserves needed to cover future losses to the NCUSIF, as past performance is not an indicator of future performance.

NCUA's internal econometric model might not accurately capture the estimated losses arising from the disruption of Uber and Lyft to taxi medallion lending credit unions.

The prices of taxi medallions -- the collateral backing the medallion loans -- have collapsed since the beginning of 2015.

This suggests that the loss rates to the NCUSIF from a failure of a taxi medallion lending credit union could be higher than past historical loss rates from other credit union failures.

In addition, at the end of the first quarter, there was not a single credit union with assets of at least $1 billion in assets with a CAMEL rating of 4 or 5.

But that is a head scratcher, because there is one taxi medallion lending credit union with $1.9 billion in assets which has seen a clear deterioration in its performance.

Once again, this would suggest that reserves are understated.

So, are NCUSIF premium assessments in the offing?

According to the NCUA, the NCUSIF contingent liability is derived by using an internal econometric model that applies estimated failure and loss rates and takes into account the historical loss history, CAMEL ratings, credit union level financial ratios, and other conditions. In addition, specific analysis is performed on those insured credit unions where failure is imminent or where additional information is available that may affect the estimate of losses.

However, I believe NCUA may be underestimating the reserves needed to cover future losses to the NCUSIF, as past performance is not an indicator of future performance.

NCUA's internal econometric model might not accurately capture the estimated losses arising from the disruption of Uber and Lyft to taxi medallion lending credit unions.

The prices of taxi medallions -- the collateral backing the medallion loans -- have collapsed since the beginning of 2015.

This suggests that the loss rates to the NCUSIF from a failure of a taxi medallion lending credit union could be higher than past historical loss rates from other credit union failures.

In addition, at the end of the first quarter, there was not a single credit union with assets of at least $1 billion in assets with a CAMEL rating of 4 or 5.

But that is a head scratcher, because there is one taxi medallion lending credit union with $1.9 billion in assets which has seen a clear deterioration in its performance.

Once again, this would suggest that reserves are understated.

So, are NCUSIF premium assessments in the offing?

Friday, June 3, 2016

FICUs Post Strong Year-over-Year Loan Growth

The National Credit Union Administration (NCUA) reported that federally insured credit unions (FICUs) posted strong year-over-year loan growth at the end of the first quarter of 2016.

According to the agency, loans grew by 10.7 percent at FICUs between the first quarter of 2015 and the first quarter of 2016. Every major loan category as of March 2016 expanded over the last year.

Delinquencies and Charge-offs Rise

NCUA reported that FICUs had almost $5.7 billion in loans that were 60 days for more past due as of March 2016 -- up from $4.9 billion a year earlier.

The delinquency rate at federally insured credit unions was 71 basis points in the first quarter, up 2 basis points from a year earlier; but down 10 basis points from December 2015. The delinquency rate for member business loans rose by 32 basis points during the quarter to 141 basis points on March 31.

FICUs had net charge-offs of $1 billion at the end of the first quarter of 2016 -- up almost 23 percent from a year go. The system’s net charge-off ratio increased slightly to an annualized 52 basis points in the first quarter, up from 47 basis points at the end of the first quarter of 2015.

Net Income Rises Year-over-Year

Federally insured credit unions reported net income of $2.3 billion for the first quarter. In comparison, FICUs reported net income of $2.2 billion for the first quarter of 2015.

The annualized return on average assets (ROAA) ratio for federally insured credit unions stood at 75 basis points the first quarter in 2016 -- unchanged from the end of 2015; but down 3 basis points from a year earlier. According to NCUA, higher net interest margin and non-operating income and lower operating expenses positively contributed to ROAA during the first quarter, while higher provisions for loan and lease losses and lower fee income negatively impacted ROAA.

Credit Unions Remain Well-Capitalized

The percentage of federally insured credit unions that were well capitalized remained steady in the first quarter with 97.8 percent reporting a net worth ratio at or above the statutorily required 7 percent. At end of first quarter of 2016, 40 federally insured credit unions were less than adequately capitalized, up from 35 FICUs at the end of 2015.

Overall, the credit union system’s aggregate net worth ratio was 10.78 percent at the end of the first quarter, down 3 basis points from a year earlier and 14 basis points from the end of 2015.

Large CUs Perform Better than Small CUs

NCUA noted that credit unions with at least $500 million in assets performed better than smaller credit unions, as large credit unions recorded the fastest growth in loans, membership and net worth, as well as the highest return on average assets.

Read the press release.

Read financial trends.

According to the agency, loans grew by 10.7 percent at FICUs between the first quarter of 2015 and the first quarter of 2016. Every major loan category as of March 2016 expanded over the last year.

- New auto loans jumped 15.4 percent to $103.0 billion.

- Used auto loans rose 13.2 percent to $166.8 billion.

- Total first-mortgage loans outstanding grew 10.4 percent to $327.9 billion.

- Other real estate loans grew by 3.9 percent to $74.3 billion.

- Net member-business loan balances increased 13 percent to $59.8 billion.

- Non-federally guaranteed student loans expanded 10.9 percent to $3.6 billion

- .Payday alternative loans originated at federal credit unions rose 8.1 percent to $106.1 million at an annual rate.

Delinquencies and Charge-offs Rise

NCUA reported that FICUs had almost $5.7 billion in loans that were 60 days for more past due as of March 2016 -- up from $4.9 billion a year earlier.

The delinquency rate at federally insured credit unions was 71 basis points in the first quarter, up 2 basis points from a year earlier; but down 10 basis points from December 2015. The delinquency rate for member business loans rose by 32 basis points during the quarter to 141 basis points on March 31.

FICUs had net charge-offs of $1 billion at the end of the first quarter of 2016 -- up almost 23 percent from a year go. The system’s net charge-off ratio increased slightly to an annualized 52 basis points in the first quarter, up from 47 basis points at the end of the first quarter of 2015.

Net Income Rises Year-over-Year

Federally insured credit unions reported net income of $2.3 billion for the first quarter. In comparison, FICUs reported net income of $2.2 billion for the first quarter of 2015.

The annualized return on average assets (ROAA) ratio for federally insured credit unions stood at 75 basis points the first quarter in 2016 -- unchanged from the end of 2015; but down 3 basis points from a year earlier. According to NCUA, higher net interest margin and non-operating income and lower operating expenses positively contributed to ROAA during the first quarter, while higher provisions for loan and lease losses and lower fee income negatively impacted ROAA.

Credit Unions Remain Well-Capitalized

The percentage of federally insured credit unions that were well capitalized remained steady in the first quarter with 97.8 percent reporting a net worth ratio at or above the statutorily required 7 percent. At end of first quarter of 2016, 40 federally insured credit unions were less than adequately capitalized, up from 35 FICUs at the end of 2015.

Overall, the credit union system’s aggregate net worth ratio was 10.78 percent at the end of the first quarter, down 3 basis points from a year earlier and 14 basis points from the end of 2015.

Large CUs Perform Better than Small CUs

NCUA noted that credit unions with at least $500 million in assets performed better than smaller credit unions, as large credit unions recorded the fastest growth in loans, membership and net worth, as well as the highest return on average assets.

Read the press release.

Read financial trends.

Thursday, June 2, 2016

NCUA Discloses Info on CUSOs

The National Credit Union Administration (NCUA) published metrics regarding approximately 900 credit union service organizations (CUSOs).

"CUSOs at a Glance" fact sheet includes information on credit union investments and loans to CUSOs, the percentage of CUSOs wholly-owned, the number of credit unions CUSOs serve, and the types of services CUSOs provide.

According to the fact sheet,

Fact Sheet.

"CUSOs at a Glance" fact sheet includes information on credit union investments and loans to CUSOs, the percentage of CUSOs wholly-owned, the number of credit unions CUSOs serve, and the types of services CUSOs provide.

According to the fact sheet,

- CUSOs reported more than $1.3 billion in investments from credit unions.

- CUSOs reported more than $447 million in loans from credit unions.

- A majority, 74 percent, of CUSOs were wholly owned by a credit union, with only five CUSOs reporting more than 100 credit union owners. One CUSO reported having more than 1,000 credit union owners.

- The majority, 95 percent, of CUSOs serve less than 100 credit union customers, with 67 percent of CUSOs serving only one credit union customer.

- The top four CUSO services are lending, member services, other services, and payment and electronic transaction processing.

Fact Sheet.

Large State Chartered CU CEO Compensation as Percent of Net Income and Non-Interest Expenses

Many readers had requested that I look at credit union CEO compensation relative to various performance metrics.

This commentary looks at the compensation relative to net income and non-interest expense.

The median CEO compensation to net income ratio was 5.35 percent. Kam Wong of Municipal Credit Union (NY) had the highest ratio of CEO compensation to net income of 104.87 percent. The next highest ratio was 72.03 percent from Bert Hash, Jr. of Municipal Employees Credit Union of Baltimore (MD). The following table looks at the 10 credit union CEOs with the highest ratio of compensation to net income.

The median CEO compensation to non-interest expense ratio was 1.63 percent. However, Glen Yeager of Utilities Employees Credit Union (PA) had the highest ratio of compensation to non-interest expense at 40.85 percent. The next highest was Olan Jones, Jr. of Eastman Credit Union (TN) at 13.62 percent. The following table looks at the 10 CEOs with the highest ratio of compensation to non-interest expense.

The following tables look at CEO compensation of state chartered credit unions with at least $1 billion in assets as a percent of net income and non-interest expenses.

This commentary looks at the compensation relative to net income and non-interest expense.

The median CEO compensation to net income ratio was 5.35 percent. Kam Wong of Municipal Credit Union (NY) had the highest ratio of CEO compensation to net income of 104.87 percent. The next highest ratio was 72.03 percent from Bert Hash, Jr. of Municipal Employees Credit Union of Baltimore (MD). The following table looks at the 10 credit union CEOs with the highest ratio of compensation to net income.

The median CEO compensation to non-interest expense ratio was 1.63 percent. However, Glen Yeager of Utilities Employees Credit Union (PA) had the highest ratio of compensation to non-interest expense at 40.85 percent. The next highest was Olan Jones, Jr. of Eastman Credit Union (TN) at 13.62 percent. The following table looks at the 10 CEOs with the highest ratio of compensation to non-interest expense.

The following tables look at CEO compensation of state chartered credit unions with at least $1 billion in assets as a percent of net income and non-interest expenses.

Wednesday, June 1, 2016

Illinois Temporarily Suspends Operations of Good Shepherd CU

The Illinois Division of Financial Institutions issued an order of suspension against Good Shepherd Credit Union (Chicago, IL).

The state regulator found that the $101 thousand credit union was operating in an unsafe and unsound manner and was substantially out of compliance with the Illinois Credit Union Act.

According to the findings, the credit union has operated at a loss in four of the last five years and has seen a dramatic decline in its net worth ratio from 19.13 percent at the end of 2014 to 8.31 percent as of December 2015. The credit union had also failed to reconcile its general ledger account balances.

The order notes that the books and records of the credit union did not reflect the true condition of the credit union. This includes not adequately funding its allowance for loan losses accounts.

Other issues cited include the board of directors not meeting as frequently as required by law and failure to notify the Department of Credit Unions regarding resignations of board members.

The order temporarily suspended the operations of the credit union for 60 days.

In addition, Jim McNeil was appointed Manager-Trustee of the credit union.

Good Shepherd Credit Union is privately-insured by American Share Insurance.

Read the Suspension Order.

Read Order Appointing Manager-Trustee.

The state regulator found that the $101 thousand credit union was operating in an unsafe and unsound manner and was substantially out of compliance with the Illinois Credit Union Act.

According to the findings, the credit union has operated at a loss in four of the last five years and has seen a dramatic decline in its net worth ratio from 19.13 percent at the end of 2014 to 8.31 percent as of December 2015. The credit union had also failed to reconcile its general ledger account balances.

The order notes that the books and records of the credit union did not reflect the true condition of the credit union. This includes not adequately funding its allowance for loan losses accounts.

Other issues cited include the board of directors not meeting as frequently as required by law and failure to notify the Department of Credit Unions regarding resignations of board members.

The order temporarily suspended the operations of the credit union for 60 days.

In addition, Jim McNeil was appointed Manager-Trustee of the credit union.

Good Shepherd Credit Union is privately-insured by American Share Insurance.

Read the Suspension Order.

Read Order Appointing Manager-Trustee.