Earlier this week, I wrote that U.S. Eagle Federal Credit Union (Albuquerque, NM) was still listing an impermissible common bond of "50 years of age or better and a resident of New Mexico" on its online membership application.

I can report that as of this morning the credit union has removed this impermissible common bond.

Below is a screen shot of this page.

Friday, April 29, 2016

Thursday, April 28, 2016

Coastal CU Secures Naming Rights to Amphitheatre (Updated)

Raleigh-based Coastal Federal Credit Union has secured the naming rights to Walnut Creek Amphitheatre in Raleigh.

The Triangle’s largest outdoor amphitheater will now be called Coastal Credit Union Music Park at Walnut Creek.

While specific deal terms were not disclosed, a news report indicated that it is a multi-year deal with options to extend it longer.

Coastal FCU has about $2.6 billion in assets.

Update:

The News & Observer is reporting that "[a]ccording to the city, Coastal will pay a total of $1.8 million over five years – $200,000 in 2016 and $400,000 each of the next four years. Raleigh and Live Nation will split the deal’s net proceeds evenly, less costs such as new signs for the venue."

Read the story.

The Triangle’s largest outdoor amphitheater will now be called Coastal Credit Union Music Park at Walnut Creek.

While specific deal terms were not disclosed, a news report indicated that it is a multi-year deal with options to extend it longer.

Coastal FCU has about $2.6 billion in assets.

Update:

The News & Observer is reporting that "[a]ccording to the city, Coastal will pay a total of $1.8 million over five years – $200,000 in 2016 and $400,000 each of the next four years. Raleigh and Live Nation will split the deal’s net proceeds evenly, less costs such as new signs for the venue."

Read the story.

Royal Credit Union to Acquire Saint Paul-based Capital Bank

Royal Credit Union (Eau Claire, WI) has entered into an agreement to acquire Capital Bank (Saint Paul, MN).

Under the terms of the agreement, Royal will assume approximately $35 million in total assets in the transaction. The deal is expected to be completed in the second half of 2016. The acquisition is still awaiting approval of state regulators, the FDIC, and NCUA.

Royal Credit Union has almost $1.8 billion in assets.

In 2010, Royal Credit Union (WI) acquired the 11 branches and $177 million in deposits from Anchor Bank (WI).

Read the press release.

Under the terms of the agreement, Royal will assume approximately $35 million in total assets in the transaction. The deal is expected to be completed in the second half of 2016. The acquisition is still awaiting approval of state regulators, the FDIC, and NCUA.

Royal Credit Union has almost $1.8 billion in assets.

In 2010, Royal Credit Union (WI) acquired the 11 branches and $177 million in deposits from Anchor Bank (WI).

Read the press release.

Investigative Report Examines Quorum's Relationship to Vacation Ownership Interest Company

In a follow up story on Diamond Resorts International, the Southern Investigative Reporting Foundation examines the relationship of Diamond Resorts International, a vacation ownership interest business, and Quorum Federal Credit Union (Purchase, NY).

The investigative report notes that Quorum Federal Credit Union has become a major lender to Diamond Resorts International. Quorum is also financing other vacation ownership interest companies.

Diamond Resorts International has entered into a $100 million loan facility agreement with Quorum FCU through the end of 2017. At the end of 2015, Diamond Resorts International represents 27 percent of Quorum's vacation ownership loans.

A former Quorum official told Southern Investigative Reporting Foundation that Diamond seemed to send its riskier loans to the credit union. Many of the loans went to applicants with credit scores below 660.

The article further points out that Quorum partnered with Diamond and other vacation ownership interest businesses to grow its membership.

According to the report, an association was used to qualify people for membership, who were seeking a timeshare loan from Quorum. When Quorum approved the loan, Diamond Resorts International purportedly deposited $25 in the borrowers savings account.

In addition, the report examines the relationship of Quorum with its credit union service organization, Vacation Ownership Funding Corporation, Inc. (VOFCO). Quorum owns 79 percent of VOFCO.

The article cites Quorum's 2015 annual report that the National Credit Union Administration is scrutinizing Quorum's Vacation Ownership Loan Program and may require Quorum to divest a large portion of its timeshare loans.

Read the report.

The investigative report notes that Quorum Federal Credit Union has become a major lender to Diamond Resorts International. Quorum is also financing other vacation ownership interest companies.

Diamond Resorts International has entered into a $100 million loan facility agreement with Quorum FCU through the end of 2017. At the end of 2015, Diamond Resorts International represents 27 percent of Quorum's vacation ownership loans.

A former Quorum official told Southern Investigative Reporting Foundation that Diamond seemed to send its riskier loans to the credit union. Many of the loans went to applicants with credit scores below 660.

The article further points out that Quorum partnered with Diamond and other vacation ownership interest businesses to grow its membership.

According to the report, an association was used to qualify people for membership, who were seeking a timeshare loan from Quorum. When Quorum approved the loan, Diamond Resorts International purportedly deposited $25 in the borrowers savings account.

In addition, the report examines the relationship of Quorum with its credit union service organization, Vacation Ownership Funding Corporation, Inc. (VOFCO). Quorum owns 79 percent of VOFCO.

The article cites Quorum's 2015 annual report that the National Credit Union Administration is scrutinizing Quorum's Vacation Ownership Loan Program and may require Quorum to divest a large portion of its timeshare loans.

Read the report.

Wednesday, April 27, 2016

Taxi Medallion Participation Loans Adversely Impact Quorum FCU

In its 2015 Annual Report, Quorum Federal Credit Union provides additional details on the performance of its $76.3 million portfolio of taxi medallion participation loans.

Taxi participation loans are collateralized by taxi medallions, primarily in the cities of Philadelphia, New York, Boston, and Chicago. Quorum owns a percentage of each loan, primarily between 80 percent and 90 percent.

Quorum reported that at the end of 2015 almost $6.1 million in taxi medallion participation loans were past due 90 days or more and were in non-accrual status. In addition, $4.35 million in taxi participation loans were 60 to 89 days past due and $2 million in taxi medallion participation loans were 30 to 59 past due.

This means 16.3 percent of all taxi medallion loans were in some stage of delinquency.

Quorum also reported 5 modified taxi medallion participation loans worth almost $6.6 million at the end of 2015.

Quorum further stated in its Annual Report:

In fact, Quorum's first quarter Call Report shows a further erosion in its performance, as more participation loans became delinquent. The credit union posted a loss of almost $3 million for the first quarter after recording a profit of $3.4 million for all of 2015. Quorum reported an increase in provisions for loan and lease losses during the first quarter of 2016 compared to a year ago -- $6.8 million versus almost $2.2 million, respectively.

This explains why Quorum is advertising to hire a commercial workout specialist.

Read the 2015 Annual Report.

Taxi participation loans are collateralized by taxi medallions, primarily in the cities of Philadelphia, New York, Boston, and Chicago. Quorum owns a percentage of each loan, primarily between 80 percent and 90 percent.

Quorum reported that at the end of 2015 almost $6.1 million in taxi medallion participation loans were past due 90 days or more and were in non-accrual status. In addition, $4.35 million in taxi participation loans were 60 to 89 days past due and $2 million in taxi medallion participation loans were 30 to 59 past due.

This means 16.3 percent of all taxi medallion loans were in some stage of delinquency.

Quorum also reported 5 modified taxi medallion participation loans worth almost $6.6 million at the end of 2015.

Quorum further stated in its Annual Report:

Recently, market disruption has occurred in the taxi industry due to new competition. This competition has negatively impacted the taxi industry, its revenues and has caused the value of taxi medallions to depreciate over the past year. Further or prolonged market disruption in the taxi industry may increase our delinquencies and non-accrual loans collateralized by taxi medallions. It is at least reasonably possible that our losses on these loans could increase in the near term due to further or prolonged market disruption impacting the value of taxi medallions.

In fact, Quorum's first quarter Call Report shows a further erosion in its performance, as more participation loans became delinquent. The credit union posted a loss of almost $3 million for the first quarter after recording a profit of $3.4 million for all of 2015. Quorum reported an increase in provisions for loan and lease losses during the first quarter of 2016 compared to a year ago -- $6.8 million versus almost $2.2 million, respectively.

This explains why Quorum is advertising to hire a commercial workout specialist.

Read the 2015 Annual Report.

Tuesday, April 26, 2016

Har-Co CU Once Again Seeks Bank Charter

The American Banker is reporting that Har-Co Credit Union (Bel Air, MD) is seeking approval from state and federal regulators to convert to a state-chartered mutual savings bank, according to legal documents.

If approved, the institution would change its name to Har-Co Community Bank.

This is the second attempt by Har-Co to switch to a mutual savings bank charter. The credit union previously attempted to convert to a bank in 2011. Har-Co members had approved the conversion; but it was never completed.

Read the American Banker story (subscription required).

Read the Notice of Consideration to Convert.

If approved, the institution would change its name to Har-Co Community Bank.

This is the second attempt by Har-Co to switch to a mutual savings bank charter. The credit union previously attempted to convert to a bank in 2011. Har-Co members had approved the conversion; but it was never completed.

Read the American Banker story (subscription required).

Read the Notice of Consideration to Convert.

Job Half Done on Impermissible Common Bond at U.S. Eagle

Over a year ago, I brought to the attention of the National Credit Union Administration (NCUA) that U.S. Eagle Federal Credit Union (Albuquerque, NM) was allowing individuals to join via an impermissible common bond based on age.

NCUA's General Counsel earlier this year issued a legal opinion letter stating that age by itself is an impermissible common bond.

As a result, U.S. Eagle, probably at NCUA's prodding, has removed from its How to Join webpage that being age 50 or better was an eligible common bond (see screen shot below from April 25 and click on image to enlarge).

Unfortunately, NCUA gets an incomplete, as the job is not done.

The credit union still lists being 50 years or better on its online application for a new member. Below is a screen shot of my March 29 e-mail to NCUA's Office of General Counsel bring this issue o NCUA's attention.

As of April 25, U.S. Eagle has not corrected its online application and still lists being 50 years of age or better and a New Mexico resident as a membership requirement. Below is a screen shot of the online application on April 25.

Until the online application is corrected, NCUA has not finished its job enforcing its common bond requirements.

NCUA's General Counsel earlier this year issued a legal opinion letter stating that age by itself is an impermissible common bond.

As a result, U.S. Eagle, probably at NCUA's prodding, has removed from its How to Join webpage that being age 50 or better was an eligible common bond (see screen shot below from April 25 and click on image to enlarge).

Unfortunately, NCUA gets an incomplete, as the job is not done.

The credit union still lists being 50 years or better on its online application for a new member. Below is a screen shot of my March 29 e-mail to NCUA's Office of General Counsel bring this issue o NCUA's attention.

As of April 25, U.S. Eagle has not corrected its online application and still lists being 50 years of age or better and a New Mexico resident as a membership requirement. Below is a screen shot of the online application on April 25.

Until the online application is corrected, NCUA has not finished its job enforcing its common bond requirements.

Monday, April 25, 2016

Palisades Credit Union Buys Naming Rights to Ballpark

Palisades Credit Union (Pearl River, NY) bought the naming rights to a 3,000 seat ballpark that is the home of the Rockland Boulders.

The ballpark will now be called Palisades Credit Union Park.

The Rockland Boulders play in the Canadian American Association of Professional Baseball.

The ballpark was formerly called Provident Bank Park.

Terms of the deal were not disclosed.

Read the story.

The ballpark will now be called Palisades Credit Union Park.

The Rockland Boulders play in the Canadian American Association of Professional Baseball.

The ballpark was formerly called Provident Bank Park.

Terms of the deal were not disclosed.

Read the story.

Proposal Paves Way for FCUs to Own Mixed-Use Properties

The National Credit Union Administration (NCUA) Board on April 21 issued a proposed rule that will eliminate the requirement that a federal credit union (FCU) must plan for, and eventually achieve, full occupancy of acquired premises.

In addition, the proposed rule modifies the definition of “partially occupy” to mean occupation and use, on a full-time basis, of at least fifty percent of the premises by the FCU, or by a combination of the FCU and a credit union service organization (CUSO) in which the FCU has a controlling interest.

This means that an FCU may lease or sell excess capacity in its facilities.

In justifying the proposed rule, NCUA Chairman Debbie Matz stated:

She further noted that the requirement that an FCU eventually take full occupancy of a mixed-use premise would mean an FCU would have to evict tenants and renters and that would not be fair.

Unfortunately, the income from leasing this excess space by an FCU is not subject to taxation, as FCUs are exempt from the unrelated business income tax (UBIT). This proposal is latest example of NCUA expanding the cost of the credit union tax exemption.

In my opinion, real estate management or the ownership of mixed-use properties is outside of the tax exempt purpose of an FCU.

Congress needs to ensure that income from leasing is subject to UBIT.

Read the proposed rule.

Read NCUA Chairman's statement.

In addition, the proposed rule modifies the definition of “partially occupy” to mean occupation and use, on a full-time basis, of at least fifty percent of the premises by the FCU, or by a combination of the FCU and a credit union service organization (CUSO) in which the FCU has a controlling interest.

This means that an FCU may lease or sell excess capacity in its facilities.

In justifying the proposed rule, NCUA Chairman Debbie Matz stated:

"In my travels during my two terms on the NCUA Board, I have seen businesses operating successfully in mixed-use buildings, where street-level space is used for retail operations and an upper floor is used for commercial rentals or private residences. These types of mixed-use zoning are especially popular in urban areas."

She further noted that the requirement that an FCU eventually take full occupancy of a mixed-use premise would mean an FCU would have to evict tenants and renters and that would not be fair.

Unfortunately, the income from leasing this excess space by an FCU is not subject to taxation, as FCUs are exempt from the unrelated business income tax (UBIT). This proposal is latest example of NCUA expanding the cost of the credit union tax exemption.

In my opinion, real estate management or the ownership of mixed-use properties is outside of the tax exempt purpose of an FCU.

Congress needs to ensure that income from leasing is subject to UBIT.

Read the proposed rule.

Read NCUA Chairman's statement.

Friday, April 22, 2016

NCUA Proposes Incentive-Based Compensation Rule

The National Credit Union Administration (NCUA) Board members unanimously approved a proposed rule (Parts 741 and 751), mandated by section 956 of the Dodd-Frank Act, that would require federally insured credit unions with assets of $1 billion or more to provide NCUA with information about the structure of future incentive-based executive compensation programs.

The Dodd-Frank Act requires NCUA and five other federal financial regulators to act jointly to prohibit incentive-based compensation payment arrangements in financial institutions with $1 billion or more in assets that the agencies determine encourage inappropriate risks by providing excessive compensation or that could lead to material financial loss.

The proposed rule supersedes an earlier rule proposed by regulators in 2011.

The proposed rule creates a tiered system by dividing financial institutions covered under the rule into three categories, each with separate requirements:

Level 1: institutions with assets of $250 billion and above;

Level 2: institutions with assets of at least $50 billion and below $250 billion; and

Level 3: institutions with assets of at least $1 billion and below $50 billion.

Only 258 federally insured credit unions have assets above $1 billion at the end of 2015. Of those, only one federally insured credit union, Navy Federal Credit Union, falls into Level 2. No federally insured credit union is classified as a Level 1 institution under the proposed rule.

The proposed rule does not affect base salary or base benefit plans. Incentive-based compensation plans that existed before the effective date of the final rule will not be affected. The rule would not affect newly created incentive compensation plans at a covered credit union until the first day of the first calendar quarter beginning 18 months after the final rule has become effective.

Institutions covered by the proposed rule would be required to create records documenting the structure of all incentive-based compensation plans, retain those records for seven years, and provide them to NCUA upon the agency's request.

Boards of directors of covered credit unions or a committee thereof would be required to exercise oversight of such compensation plans. The proposed rule includes a provision to address equitable tax treatment for incentive-based compensation plans in covered credit unions.

Both Level 1 and 2 institutions would be required to defer a percentage of qualifying incentive-based compensation for executives and significant risk takers for a specified amount of time. Level 1 institutions would be required to defer 60 percent for executives and 50 percent for significant risk takers for a minimum of four years, while Level 2 institutions would be required to defer 50 percent for senior executives and 40 percent for significant risk-takers for a period of at least three years. Regulators would have discretion over requirements for Level 3 institutions.

In cases of employee fraud, intentional misrepresentation or misconduct resulting in significant financial or reputational harm to the institution, some or all of the compensation would be subject to claw-back recovery.

Read the proposed rule. Read the two page guide.

The Dodd-Frank Act requires NCUA and five other federal financial regulators to act jointly to prohibit incentive-based compensation payment arrangements in financial institutions with $1 billion or more in assets that the agencies determine encourage inappropriate risks by providing excessive compensation or that could lead to material financial loss.

The proposed rule supersedes an earlier rule proposed by regulators in 2011.

The proposed rule creates a tiered system by dividing financial institutions covered under the rule into three categories, each with separate requirements:

Level 1: institutions with assets of $250 billion and above;

Level 2: institutions with assets of at least $50 billion and below $250 billion; and

Level 3: institutions with assets of at least $1 billion and below $50 billion.

Only 258 federally insured credit unions have assets above $1 billion at the end of 2015. Of those, only one federally insured credit union, Navy Federal Credit Union, falls into Level 2. No federally insured credit union is classified as a Level 1 institution under the proposed rule.

The proposed rule does not affect base salary or base benefit plans. Incentive-based compensation plans that existed before the effective date of the final rule will not be affected. The rule would not affect newly created incentive compensation plans at a covered credit union until the first day of the first calendar quarter beginning 18 months after the final rule has become effective.

Institutions covered by the proposed rule would be required to create records documenting the structure of all incentive-based compensation plans, retain those records for seven years, and provide them to NCUA upon the agency's request.

Boards of directors of covered credit unions or a committee thereof would be required to exercise oversight of such compensation plans. The proposed rule includes a provision to address equitable tax treatment for incentive-based compensation plans in covered credit unions.

Both Level 1 and 2 institutions would be required to defer a percentage of qualifying incentive-based compensation for executives and significant risk takers for a specified amount of time. Level 1 institutions would be required to defer 60 percent for executives and 50 percent for significant risk takers for a minimum of four years, while Level 2 institutions would be required to defer 50 percent for senior executives and 40 percent for significant risk-takers for a period of at least three years. Regulators would have discretion over requirements for Level 3 institutions.

In cases of employee fraud, intentional misrepresentation or misconduct resulting in significant financial or reputational harm to the institution, some or all of the compensation would be subject to claw-back recovery.

Read the proposed rule. Read the two page guide.

Thursday, April 21, 2016

Home-Based CUs Beat Back NCUA

The Wall Street journal is reporting that the National Credit Union Administration (NCUA) has backed off a proposal that would have required home-based credit unions to operate out of commercial locations.

The article notes that a 2013 proposed rule that would have required home-based credit unions to operate out of commercial locations faced stiff opposition.

NCUA justified the 2013 proposed rule by stating that sometimes its examiners were forced to work in unheated basements and risked being attacked by unfriendly dogs when they visited home-based credit unions.

The article points out that NCUA is taking a gentler approach with home-based credit unions.

Read the story (subscription required).

The article notes that a 2013 proposed rule that would have required home-based credit unions to operate out of commercial locations faced stiff opposition.

NCUA justified the 2013 proposed rule by stating that sometimes its examiners were forced to work in unheated basements and risked being attacked by unfriendly dogs when they visited home-based credit unions.

The article points out that NCUA is taking a gentler approach with home-based credit unions.

Read the story (subscription required).

Number of Problem CUs Fell During the First Quarter of 2016

The National Credit Union Administration (NCUA) reported that the number of problem credit unions fell during the first quarter.

At the end of the first quarter, there were 218 problem credit unions. In comparison, there were 220 problem credit unions at the end of the fourth quarter of 2015 and 258 credit unions at the end of the first quarter of 2015.

A problem credit union has a composite CAMEL rating of 4 or 5.

During the first quarter both total shares (deposits) and assets in problem credit unions fell. Shares in problem credit unions decreased from $7.7 billion at the end of 2015 to $7.5 billion as of March 31, 2016 . Over the same time period, assets in problem credit unions fell from $8.6 billion to $7.8 billion. A year earlier, problem credit unions held $10.3 billion in shares and $11.6 billion in assets.

According to NCUA, 0.78 percent of total insured shares and 0.6 percent of industry assets were in problem credit unions at the end of the first quarter.

According to NCUA, 93 percent of all problem credit unions had less than $100 million in shares, while approximately 1 percent of the problem credit unions had shares of $500 million or more.

NCUA reported that no credit union with at least $1 billion in assets was a problem credit union as of March 31, 2016. The number of problem credit unions with between $500 million and $1 billion in assets declined by 1 during the quarter to 2 credit unions. The number of problem credit unions with between $100 million and $500 million in assets fell from 15 at the end of 2015 to 14 at the end of the first quarter of 2016. Only credit unions with less than $10 million in assets saw an increase in the number of problem credit unions by 3 during the quarter to 126 credit unions.

At the end of the first quarter, there were 218 problem credit unions. In comparison, there were 220 problem credit unions at the end of the fourth quarter of 2015 and 258 credit unions at the end of the first quarter of 2015.

A problem credit union has a composite CAMEL rating of 4 or 5.

During the first quarter both total shares (deposits) and assets in problem credit unions fell. Shares in problem credit unions decreased from $7.7 billion at the end of 2015 to $7.5 billion as of March 31, 2016 . Over the same time period, assets in problem credit unions fell from $8.6 billion to $7.8 billion. A year earlier, problem credit unions held $10.3 billion in shares and $11.6 billion in assets.

According to NCUA, 0.78 percent of total insured shares and 0.6 percent of industry assets were in problem credit unions at the end of the first quarter.

According to NCUA, 93 percent of all problem credit unions had less than $100 million in shares, while approximately 1 percent of the problem credit unions had shares of $500 million or more.

NCUA reported that no credit union with at least $1 billion in assets was a problem credit union as of March 31, 2016. The number of problem credit unions with between $500 million and $1 billion in assets declined by 1 during the quarter to 2 credit unions. The number of problem credit unions with between $100 million and $500 million in assets fell from 15 at the end of 2015 to 14 at the end of the first quarter of 2016. Only credit unions with less than $10 million in assets saw an increase in the number of problem credit unions by 3 during the quarter to 126 credit unions.

Wednesday, April 20, 2016

Evansville Teachers FCU Breaks Ground on $22 Million HQ

Evansville Teachers Federal Credit Union has broken ground on its new three-story, 82,500 square-foot headquarters building.

The project will cost an estimated $22 million.

Read the story.

The project will cost an estimated $22 million.

Read the story.

Tuesday, April 19, 2016

NLRB: TruStone Financial FCU Violated Federal Labor Law

The National Labor Relations Board (NLRB) has ruled against TruStone Financial Federal Credit Union (Plymouth, MN) in a dispute over the credit union's decision to close two branch offices that were staffed by unionized employees, and then to reopen branches nearby with non-union employees.

TruStone notified Office and Professional Employees International Union (OPEIU) Local 12 in 2015 that the credit union would close its Golden Valley and Apple Valley locations and open two new branch offices nearby. TruStone said the Golden Valley and Apple Valley union employees could apply to transfer to another bargaining unit location or apply for a job at the “new” facilities, which the credit union declared would be non-union.

OPEIU Local 12 filed unfair labor practice charges with the NLRB.

The administrative law judge found that the credit union's actions violated Federal labor law.

To remedy TruStone’s unlawful actions, the NLRB judge ordered:

Read the decision.

TruStone notified Office and Professional Employees International Union (OPEIU) Local 12 in 2015 that the credit union would close its Golden Valley and Apple Valley locations and open two new branch offices nearby. TruStone said the Golden Valley and Apple Valley union employees could apply to transfer to another bargaining unit location or apply for a job at the “new” facilities, which the credit union declared would be non-union.

OPEIU Local 12 filed unfair labor practice charges with the NLRB.

The administrative law judge found that the credit union's actions violated Federal labor law.

To remedy TruStone’s unlawful actions, the NLRB judge ordered:

- TruStone must apply its collective bargaining agreement with OPEIU Local 12 to the two relocated branch offices;

- TruStone must offer four employees “who were unlawfully denied transfers to those facilities immediate transfers to those facilities, if they so choose;”

- TruStone must “make affected employees [at the relocated facilities] whole for any losses of earnings or benefits they may have suffered because of the failure to apply the bargaining agreement to them…”

Read the decision.

Colorado State Chartered CUs May Pay Directors Beginning on August 10, 2016

Colorado Governor John Hickenlooper signed SB 125: Credit Union Governance into law.

The new law will give state chartered credit unions in Colorado the ability to compensate board members.

SB 125 will also allow an audit committee to replace a supervisory committee.

The new law goes into effect August 10, 2016.

The new law will give state chartered credit unions in Colorado the ability to compensate board members.

SB 125 will also allow an audit committee to replace a supervisory committee.

The new law goes into effect August 10, 2016.

Monday, April 18, 2016

Serving the Credit-Invisibles

In a new report Serving the Credit-Invisible, the National Credit Union Administration (NCUA) describes how credit unions can serve people with no or thin credit histories.

“Credit-invisibles” are consumers whose documented credit history is so limited that they don’t have credit scores or their credit scores are not based on a complete history of debt repayment. The Consumer Financial Protection Bureau estimates that 26 million U.S. adults have no credit history with the three national credit bureaus -- TransUnion, Experian, and Equifax.

NCUA notes that if a credit union is going to develop a loan program to serve the credit-invisibles, the credit union will need to put in place stronger loan review processes to properly assess the creditworthiness of an applicant. Factors that may go into the loan underwriting decision may include stability of residency; length of employment; employment income; past judgments, bankruptcies or charge-offs; current debts and payment amounts; and more.

NCUA advises that the loan application must provide enough detail for the underwriter to properly assess the risk of non-payment. In addition, potential credit-invisible borrowers should be interviewed before the credit decision is made.

The credit union will need to have appropriate monitoring and control mechanisms, due to the increased risk of default with credit-invisibles.

For example, NCUA states that a collection program must be established before implementing the credit-invisible loan program. NCUA recommends credit-invisible collection practices should aggressively pursue missed payments. Also, to assist in the collection process, credit unions should consider loss-protection insurance and GAP insurance to protect the credit union against losses.

If an auto loan is made to these individuals, NCUA recommends installing a global positioning system to help with collection efforts.

Of course, the agency advises that the credit union consult with legal counsel before implementing any collection program to ensure that the program complies with state and federal laws.

“Credit-invisibles” are consumers whose documented credit history is so limited that they don’t have credit scores or their credit scores are not based on a complete history of debt repayment. The Consumer Financial Protection Bureau estimates that 26 million U.S. adults have no credit history with the three national credit bureaus -- TransUnion, Experian, and Equifax.

NCUA notes that if a credit union is going to develop a loan program to serve the credit-invisibles, the credit union will need to put in place stronger loan review processes to properly assess the creditworthiness of an applicant. Factors that may go into the loan underwriting decision may include stability of residency; length of employment; employment income; past judgments, bankruptcies or charge-offs; current debts and payment amounts; and more.

NCUA advises that the loan application must provide enough detail for the underwriter to properly assess the risk of non-payment. In addition, potential credit-invisible borrowers should be interviewed before the credit decision is made.

The credit union will need to have appropriate monitoring and control mechanisms, due to the increased risk of default with credit-invisibles.

For example, NCUA states that a collection program must be established before implementing the credit-invisible loan program. NCUA recommends credit-invisible collection practices should aggressively pursue missed payments. Also, to assist in the collection process, credit unions should consider loss-protection insurance and GAP insurance to protect the credit union against losses.

If an auto loan is made to these individuals, NCUA recommends installing a global positioning system to help with collection efforts.

Of course, the agency advises that the credit union consult with legal counsel before implementing any collection program to ensure that the program complies with state and federal laws.

Saturday, April 16, 2016

Lake Michigan CU Establishes Second Home in SW Florida

Lake Michigan Credit Union (Grand Rapids, Michigan) is expanding to Southwest Florida.

A news story reported that the $4.3 billion credit union opened a branch last October in Bonita Springs, Florida.

The credit union's CEO, Sandra Jelinski, told the Business Observer that the credit union plans to make a big push into the Southwest Florida market.

The credit union is opening two branches in Naples this year.

She also stated that the credit union plans to grow through acquisition and that Lake Michigan Credit Union is currently scouting community banks with less than $500 million in assets for acquisition.

Jelinski predicts that in two to three years approximately half of the credit union's assets will be Florida based.

But Jelinski has ambitions to branch out from Southwest Florida, noting that West Palm Beach is an appealing market.

Read the story.

A news story reported that the $4.3 billion credit union opened a branch last October in Bonita Springs, Florida.

The credit union's CEO, Sandra Jelinski, told the Business Observer that the credit union plans to make a big push into the Southwest Florida market.

The credit union is opening two branches in Naples this year.

She also stated that the credit union plans to grow through acquisition and that Lake Michigan Credit Union is currently scouting community banks with less than $500 million in assets for acquisition.

Jelinski predicts that in two to three years approximately half of the credit union's assets will be Florida based.

But Jelinski has ambitions to branch out from Southwest Florida, noting that West Palm Beach is an appealing market.

Read the story.

Friday, April 15, 2016

UBS to Pay $69.8 Million to NCUA

The National Credit Union Administration will receive $69.8 million from UBS in damages and interest for claims arising from losses to Members United and Southwest, two corporate credit unions that failed during the financial crisis, related to purchases of residential mortgage-backed securities.

In February, NCUA accepted UBS's offer of judgment of $33 million in damages. With the addition of prejudgment interest determined by the court, the amount to be paid by UBS increased to $69.8 million. UBS will also be liable for attorneys' fees and expenses in an amount to be determined.

To date, NCUA has obtained more than $3.1 billion in legal recoveries in litigation related to the sale of faulty securities to corporate credit unions.

Read the press release.

In February, NCUA accepted UBS's offer of judgment of $33 million in damages. With the addition of prejudgment interest determined by the court, the amount to be paid by UBS increased to $69.8 million. UBS will also be liable for attorneys' fees and expenses in an amount to be determined.

To date, NCUA has obtained more than $3.1 billion in legal recoveries in litigation related to the sale of faulty securities to corporate credit unions.

Read the press release.

More Bad News for CUs Holding Taxi Medallion Loans

There is more bad news for credit unions holding taxi medallion loans, as taxi medallions continue to decline in value and taxicab operators experience a drop in revenues.

Data from New York City and Chicago show that taxi medallion prices are still falling and have not stabilized.

The New York City Taxi and Limousine Commission reported two medallion sales in March 2016 at $520,000 and $580,000. In October 2015, taxi medallions sold at $675,000 to $700,000.

In Chicago, the transfer prices for taxi medallions ranged between $50,000 and $95,500 during the first quarter of 2016. In comparison, taxi medallions sold for $238,000 and $150,000 in October 2015.

Unless borrowers bring additional outside equity to the table, these taxi medallion lending credit unions will have difficulty refinancing these loans, when these loans mature.

In addition, taxi medallion owner revenues are falling, which cannot support medallion values. According to a recent report by Morgan Stanley, management at Signature Bank stated that the average annual income that a taxi driver generates has declined 13.5 percent peak to current, from $52,000 to $45,000. This raises concerns that the cash flows will not be sufficient to repay these taxi medallion loans.

All this indicates is that taxi medallion credit unions will need to increase provisions on these loans, as these credit unions are certain to write-off a significant portion of their taxi medallion loan portfolio. This will negatively impact the earnings at these credit unions, as well as net worth.

Note: Morgan Stanley's base assumption is the cumulative loss rate on Signature's Bank taxi medallion loan portfolio is 25 percent and worst case cumulative loss rate scenario is a 50 percent.

Data from New York City and Chicago show that taxi medallion prices are still falling and have not stabilized.

The New York City Taxi and Limousine Commission reported two medallion sales in March 2016 at $520,000 and $580,000. In October 2015, taxi medallions sold at $675,000 to $700,000.

In Chicago, the transfer prices for taxi medallions ranged between $50,000 and $95,500 during the first quarter of 2016. In comparison, taxi medallions sold for $238,000 and $150,000 in October 2015.

Unless borrowers bring additional outside equity to the table, these taxi medallion lending credit unions will have difficulty refinancing these loans, when these loans mature.

In addition, taxi medallion owner revenues are falling, which cannot support medallion values. According to a recent report by Morgan Stanley, management at Signature Bank stated that the average annual income that a taxi driver generates has declined 13.5 percent peak to current, from $52,000 to $45,000. This raises concerns that the cash flows will not be sufficient to repay these taxi medallion loans.

All this indicates is that taxi medallion credit unions will need to increase provisions on these loans, as these credit unions are certain to write-off a significant portion of their taxi medallion loan portfolio. This will negatively impact the earnings at these credit unions, as well as net worth.

Note: Morgan Stanley's base assumption is the cumulative loss rate on Signature's Bank taxi medallion loan portfolio is 25 percent and worst case cumulative loss rate scenario is a 50 percent.

Thursday, April 14, 2016

NCUA Will Receive $50.3 Million from Credit Suisse

Credit Suisse will pay the National Credit Union Administration (NCUA) $50.3 million in damages and interest for claims arising from losses to Members United and Southwest corporate credit unions related to purchases of residential mortgage-backed securities.

In March, NCUA accepted Credit Suisse’s offer of judgment of $29 million in damages. With the addition of prejudgment interest determined by the Court, the amount to be paid by Credit Suisse increased to $50.3 million. Credit Suisse will also be liable for attorneys’ fees and expenses in an amount to be determined.

Read the press release.

In March, NCUA accepted Credit Suisse’s offer of judgment of $29 million in damages. With the addition of prejudgment interest determined by the Court, the amount to be paid by Credit Suisse increased to $50.3 million. Credit Suisse will also be liable for attorneys’ fees and expenses in an amount to be determined.

Read the press release.

Wednesday, April 13, 2016

CUSOs Fuel Michigan CUs Business Lending Growth

Credit union service organizations (CUSOs) have played a key role in growing business lending at Michigan's credit unions, according to an article in Crain's Detroit Business.

The article notes that Ann Arbor-based Michigan Business Alliance (MBA), which is a CUSO, does underwriting and portfolio management on behalf of some 36 credit unions around the state. MBA started modestly, with a loan portfolio of $3.2 million at the end of 2004, and grew that to $423 million at the end of 2014 and $460 million at the end of last year. MBA stated that its commercial lending sweet spot are loans of $50,000 to $5 million.

Another CUSO, Troy-based Commercial Alliance LLC, has booked commercial loans of $46.3 million in 2011 and serviced a portfolio of $179.7 million. In 2015, it booked commercial loans of $156 million and serviced a portfolio of $388.7 million for 135 credit unions in the state. The CUSO has booked $39 million in loans with two weeks left in the first quarter.

The growth of commercial lending at CUSOs is a potential vulnerability for the credit union industry as the National Credit Union Administration does not have the power to examine third party service providers.

Read the story.

The article notes that Ann Arbor-based Michigan Business Alliance (MBA), which is a CUSO, does underwriting and portfolio management on behalf of some 36 credit unions around the state. MBA started modestly, with a loan portfolio of $3.2 million at the end of 2004, and grew that to $423 million at the end of 2014 and $460 million at the end of last year. MBA stated that its commercial lending sweet spot are loans of $50,000 to $5 million.

Another CUSO, Troy-based Commercial Alliance LLC, has booked commercial loans of $46.3 million in 2011 and serviced a portfolio of $179.7 million. In 2015, it booked commercial loans of $156 million and serviced a portfolio of $388.7 million for 135 credit unions in the state. The CUSO has booked $39 million in loans with two weeks left in the first quarter.

The growth of commercial lending at CUSOs is a potential vulnerability for the credit union industry as the National Credit Union Administration does not have the power to examine third party service providers.

Read the story.

Tuesday, April 12, 2016

Fortera Credit Union Buys Naming Rights to Austin Peay University Football Stadium

Governor’s Stadium, the home field of Clarksville, Tennessee-based Austin Peay State University’s football program, will be renamed Fortera Stadium following a 25-year partnership with the credit union.

Fortera Credit Union is paying $2.5 million for the naming rights over that period.

Fortera Credit Union was formerly known as Fort Campbell Federal Credit Union.

Read the story.

Fortera Credit Union is paying $2.5 million for the naming rights over that period.

Fortera Credit Union was formerly known as Fort Campbell Federal Credit Union.

Read the story.

Monday, April 11, 2016

NCUA Recovers $575 Million in Goldman Sachs Settlement

The National Credit Union Administration (NCUA) recovered $575 million from Goldman Sachs $5 billion settlement with the U.S. Department of Justice over faulty mortgage-backed securities sold to failed corporate credit unions.

The settlement resolves two lawsuits filed by NCUA as liquidating agent for three corporate credit unions — U.S. Central, WesCorp and Southwest — against Goldman Sachs.

Gross recoveries from NCUA's lawsuits over faulty mortgage-backed securities sold toe five failed corporate credit unions now surpass $3 billion.

Read the press release.

The settlement resolves two lawsuits filed by NCUA as liquidating agent for three corporate credit unions — U.S. Central, WesCorp and Southwest — against Goldman Sachs.

Gross recoveries from NCUA's lawsuits over faulty mortgage-backed securities sold toe five failed corporate credit unions now surpass $3 billion.

Read the press release.

NASCUS: State Laws Should Apply to FISCUs Seeking to Change Charters

In a letter to the National Credit Union Administration (NCUA), Brian Knight, General Counsel of the National Association of State Credit Union Supervisors (NASCUS), wrote that NCUA should amend Section 741.208 of its regulations to recognize that state law should govern the conversion of a federally insured state credit union (FISCU) to non-credit union status.

This letter was brought to my attention by Marvin Umholtz's CU Strategic Hot Topics newsletter.

Brian Knight wrote:

NCUA needs to amend its onerous and burdensome conversion rules making it easier for all credit unions, just not state charters, to opt for non-credit union status.

This letter was brought to my attention by Marvin Umholtz's CU Strategic Hot Topics newsletter.

Brian Knight wrote:

Part 741.208 applies NCUA’s restrictive charter conversion and termination of share insurance rules to FISCU. NASCUS concedes that the Federal Credit Union Act gives NCUA authority for rulemaking with respect to credit union to non-credit union charter conversions. However, Congress’s grant of authority in this arena was intended as limiting. NCUA should show deference to state laws addressing conversions or mergers into non-credit unions. With respect to FISCUs, NCUA is only the share insurer, not the chartering authority. NCUA’s only concern in the conversion of a FISCU to non-credit union or non-NCUSIF [National Credit Union Share Insurance Fund] charter is preventing regulatory arbitrage, or any safety and soundness risk posed by reputational concerns. However, in the case of conversion to bank charter, the entity would remain federally insured, mitigating reputational risk. Vindication of the members’ rights and other governance issues are properly left to the chartering regulator – in these cases, the states.I totally agree with Brian Knight that Congress intended to limit NCUA's authority dealing with charter conversions. The Credit Union Membership Access Act of 1998 instructed NCUA to pass regulations that are no stricter than similar regulations promulgated by the other federal banking agencies.

NCUA needs to amend its onerous and burdensome conversion rules making it easier for all credit unions, just not state charters, to opt for non-credit union status.

Sunday, April 10, 2016

Bethpage Refinances Medical Office Building

Bethpage Federal Credit Union (Bethpage, NY) provided a $28 million commercial mortgage to refinance an eight-story 72,000-square-foot medical office building in Brooklyn.

New York developer David Marx of Marx Development Group received the loan.

The loan has a five-year term with a fixed-rate of 4.25 percent.

To date, this is the largest loan to be closed by Bethpage Federal Credit Union.

Do real estate developers need taxpayer subsidized loans?

Read the story.

New York developer David Marx of Marx Development Group received the loan.

The loan has a five-year term with a fixed-rate of 4.25 percent.

To date, this is the largest loan to be closed by Bethpage Federal Credit Union.

Do real estate developers need taxpayer subsidized loans?

Read the story.

Saturday, April 9, 2016

Bank and CU Trade Groups Seek Clarifications to Military Lending Rule

Bank and credit union trade groups are urging the Department of Defense to issue clarifications and changes to the new Military Lending Act regulations taking effect in October.

The regulations tighten restrictions on lending to service members and their families and incorporate a “military APR,” an all-in APR capped at 36 percent that differs from the definition of APR under Regulation Z.

The problems identified include the apparent prohibition on borrowers making payments by checks or ACH debits and on security interests in deposited funds; the possibility of requiring multiple credit agreements; the timing of written disclosures; the need for individualized oral disclosures; the timing of military status database inquiries; safe harbors for assignees; the lack of an exemption for credit secured by real estate with no dwelling on it; and elements of the MAPR calculation.

The trade groups wrote that "providing guidance on the issues ... will help ensure that military personnel and their spouses and dependents continue to have access to a wide range of credit products.”

The American Bankers Association, the American Financial Service Association, the Association of Military Banks of America, the Consumer Bankers Association, the Credit Union National Association, the Independent Community Bankers of America, the National Association of Federal Credit Unions, and the Financial Services Roundtable submitted the recommendations for clarifications and modifications.

Read the letter.

The regulations tighten restrictions on lending to service members and their families and incorporate a “military APR,” an all-in APR capped at 36 percent that differs from the definition of APR under Regulation Z.

The problems identified include the apparent prohibition on borrowers making payments by checks or ACH debits and on security interests in deposited funds; the possibility of requiring multiple credit agreements; the timing of written disclosures; the need for individualized oral disclosures; the timing of military status database inquiries; safe harbors for assignees; the lack of an exemption for credit secured by real estate with no dwelling on it; and elements of the MAPR calculation.

The trade groups wrote that "providing guidance on the issues ... will help ensure that military personnel and their spouses and dependents continue to have access to a wide range of credit products.”

The American Bankers Association, the American Financial Service Association, the Association of Military Banks of America, the Consumer Bankers Association, the Credit Union National Association, the Independent Community Bankers of America, the National Association of Federal Credit Unions, and the Financial Services Roundtable submitted the recommendations for clarifications and modifications.

Read the letter.

Indiana Members CU Sponsoring Pittsburgh Pirates Triple-A Baseball Club

Indiana Members Credit Union (IMCU) announced its sponsorship of the Indianapolis Indians starting with the 2016 baseball season.

The sponsorship includes an exclusive Indianapolis Indians debit card, website advertising, TV and radio advertisements, in-stadium display and a new in-game strikeout feature called “IMCU Later”.

The Indianapolis Indians are a professional Triple-A baseball club affiliated with the Pittsburgh Pirates.

The terms of the sponsorship agreement were not disclosed.

The sponsorship includes an exclusive Indianapolis Indians debit card, website advertising, TV and radio advertisements, in-stadium display and a new in-game strikeout feature called “IMCU Later”.

The Indianapolis Indians are a professional Triple-A baseball club affiliated with the Pittsburgh Pirates.

The terms of the sponsorship agreement were not disclosed.

Friday, April 8, 2016

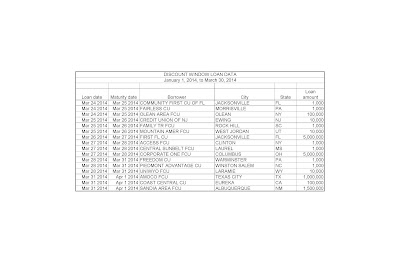

CU Borrowings from Federal Reserve Discount Window, Q1 2014

The Federal Reserve reported that 116 credit unions borrowed from its Discount Window during the first quarter of 2014.

In comparison, 100 credit unions borrowed from the Federal Reserve during the fourth quarter of 2013.

The Federal Reserve is required to disclose with a two year delay information on borrowings from the Discount Window.

The aggregate number of transactions were 121. The aggregate amount borrowed was $79.124 million.

The average amount borrowed from the Discount Window by a credit union was $653,917. The median Discount Window borrowing was $10,000. This indicates that numerous borrowings by credit unions were to test their ability to access the Federal Reserve's Discount Window.

Almost all credit unions that borrowed from the Federal Reserve's Discount Window did so through the primary credit program, which is reserved for healthy institutions.

In comparison, 100 credit unions borrowed from the Federal Reserve during the fourth quarter of 2013.

The Federal Reserve is required to disclose with a two year delay information on borrowings from the Discount Window.

The aggregate number of transactions were 121. The aggregate amount borrowed was $79.124 million.

The average amount borrowed from the Discount Window by a credit union was $653,917. The median Discount Window borrowing was $10,000. This indicates that numerous borrowings by credit unions were to test their ability to access the Federal Reserve's Discount Window.

Almost all credit unions that borrowed from the Federal Reserve's Discount Window did so through the primary credit program, which is reserved for healthy institutions.

Thursday, April 7, 2016

Outstanding Consumer Credit at Credit Unions Rose in February

The Federal Reserve reported today that outstanding consumer credit at credit unions increased by $1.6 billion in February to $347.5 billion.

Revolving credit at credit unions fell in February by approximately $700 million to $48.3 billion. This was the second consecutive monthly decline in revolving credit at credit unions.

On the other hand, non-revolving credit grew by $2.3 billion to $299.2 billion in February.

To view the data, click here.

Revolving credit at credit unions fell in February by approximately $700 million to $48.3 billion. This was the second consecutive monthly decline in revolving credit at credit unions.

On the other hand, non-revolving credit grew by $2.3 billion to $299.2 billion in February.

To view the data, click here.

Wednesday, April 6, 2016

NCUA Closes Six Philadelphia-Area CUs

The National Credit Union Administration (NCUA) liquidated six federal credit unions in the Philadelphia, Pennsylvania, area.

The six liquidated credit unions are Cardozo Lodge Federal Credit Union of Bensalem, Chester Upland School Employees Federal Credit Union of Chester, Electrical Inspectors Federal Credit Union of Bensalem, O P S EMP Federal Credit Union of Bensalem, Servco Federal Credit Union of Bensalem, and Triangle Interests % Service Center Federal Credit Union of Bensalem.

NCUA made the decision to liquidate the six federal credit unions and discontinue operations after determining the credit unions were insolvent and had no prospect for restoring viable operations.

According to NCUA, all six credit unions received management and recordkeeping services from Service Center for Credit Unions, Inc., in Bensalem.

NCUA will probably use these failures to once again call on Congress to grant the agency the same authority as other federal banking regulators to examine third-party service providers.

There have now been ten federally insured credit union liquidations in 2016.

Read the press release.

The six liquidated credit unions are Cardozo Lodge Federal Credit Union of Bensalem, Chester Upland School Employees Federal Credit Union of Chester, Electrical Inspectors Federal Credit Union of Bensalem, O P S EMP Federal Credit Union of Bensalem, Servco Federal Credit Union of Bensalem, and Triangle Interests % Service Center Federal Credit Union of Bensalem.

NCUA made the decision to liquidate the six federal credit unions and discontinue operations after determining the credit unions were insolvent and had no prospect for restoring viable operations.

According to NCUA, all six credit unions received management and recordkeeping services from Service Center for Credit Unions, Inc., in Bensalem.

NCUA will probably use these failures to once again call on Congress to grant the agency the same authority as other federal banking regulators to examine third-party service providers.

There have now been ten federally insured credit union liquidations in 2016.

Read the press release.

BECU Becomes the Official Credit Union for Seattle Sounders FC

Major League Soccer's Seattle Sounders FC announced that it has reached a partnership agreement with BECU to become the official credit union of Sounders FC.

The sponsorship will include signage and promotions.

In addition, BECU will make a $250 donation to support financial literacy programs at YouthCare for every Sounders FC goalkeeper save on the field during regular season home matches.

Terms of the sponsorship were not disclosed.

Read the story.

The sponsorship will include signage and promotions.

In addition, BECU will make a $250 donation to support financial literacy programs at YouthCare for every Sounders FC goalkeeper save on the field during regular season home matches.

Terms of the sponsorship were not disclosed.

Read the story.

Tuesday, April 5, 2016

Summit CU Proposes New Corporate HQ

Summit Credit Union (Madison, WI) has proposed building a new 10 story, 140,000 square foot corporate headquarters in Madison.

The planned office building would consolidate administrative staff that is spread out across the Madison area and would accommodate future growth.

The cost of the proposed project was not disclosed.

Read the story.

The planned office building would consolidate administrative staff that is spread out across the Madison area and would accommodate future growth.

The cost of the proposed project was not disclosed.

Read the story.

Monday, April 4, 2016

Acquisition of Failed Montauk CU Eliminates Bethpage FCU Geographic Common Bond Limits

Long Island Business News is reporting that the merger of Montauk Credit Union (New York, NY) into Bethpage Federal Credit Union (Bethpage, NY) eliminated any geographic limits on Bethpage's field of membership.

On March 31, the National Credit Union Administration (NCUA) merged the failed taxi medallion lender Montauk Credit Union into Bethpage Federal Credit Union.

Long Island Business News wrote:

Bethpage spokesperson indicated that the credit union would in the near-term focus on expanding its operations in the tri-state area.

Being able to shed geographic limits on its field of membership might explain why Bethpage was willing to do this merger without NCUA's assistance.

Read more.

On March 31, the National Credit Union Administration (NCUA) merged the failed taxi medallion lender Montauk Credit Union into Bethpage Federal Credit Union.

Long Island Business News wrote:

Linda Armyn, Bethpage senior vice president of corporate affairs, said the merger gives others around the nation access to the credit union, ending any geographic limits.

“Our territory has expanded beyond Long Island and we now have a branch in New York City,” Armyn said. “Our charter is not limited by geography at this time.”

While she said Bethpage can now serve people around the nation, the credit union at least in the short-term doesn’t plan to seek to expand across the country.

Bethpage spokesperson indicated that the credit union would in the near-term focus on expanding its operations in the tri-state area.

Being able to shed geographic limits on its field of membership might explain why Bethpage was willing to do this merger without NCUA's assistance.

Read more.

Friday, April 1, 2016

NCUA Opposed to Government Watchdog Recommendation on Reforming Regulatory Structure

The National Credit Union Administration (NCUA) disagreed with the Government Accountability Office (GAO) that Congress should consider consolidating regulatory agencies to eliminate regulatory fragmentation and overlap.

The GAO study found that the U.S. financial regulatory structure is complex, with responsibilities fragmented among a number of regulators that have overlapping authorities. GAO wrote that this fragmented regulatory structure introduces inefficiencies in the regulatory process; inconsistencies in how regulators conduct oversight activities over similar types of institutions, products, and risks; the potential for duplication in regulators’ oversight activities; and differences in the levels of protection provided to consumers.

The GAO recommended that Congress should consider whether additional changes to the financial regulatory structure are needed to reduce or better manage fragmentation and overlap in the oversight of financial institutions and activities. GAO believes that reducing regulatory fragmentation and overlap would improve (1) the efficiency and effectiveness of oversight; (2) the consistency of consumer protections; and (3) the consistency of financial oversight for similar institutions, products, risks, and services.

However, NCUA disagreed with GAO's suggestion that Congress consider whether additional changes are needed to the regulatory structure. NCUA stated that consideration of changes to the regulatory structure would need to include a careful review of the costs and benefits.

Read the GAO Report.

The GAO study found that the U.S. financial regulatory structure is complex, with responsibilities fragmented among a number of regulators that have overlapping authorities. GAO wrote that this fragmented regulatory structure introduces inefficiencies in the regulatory process; inconsistencies in how regulators conduct oversight activities over similar types of institutions, products, and risks; the potential for duplication in regulators’ oversight activities; and differences in the levels of protection provided to consumers.

The GAO recommended that Congress should consider whether additional changes to the financial regulatory structure are needed to reduce or better manage fragmentation and overlap in the oversight of financial institutions and activities. GAO believes that reducing regulatory fragmentation and overlap would improve (1) the efficiency and effectiveness of oversight; (2) the consistency of consumer protections; and (3) the consistency of financial oversight for similar institutions, products, risks, and services.

However, NCUA disagreed with GAO's suggestion that Congress consider whether additional changes are needed to the regulatory structure. NCUA stated that consideration of changes to the regulatory structure would need to include a careful review of the costs and benefits.

Read the GAO Report.